Beneficial ownership transparency in Ghana

The beneficial ownership regime in Ghana

This section of the scoping report presents an assessment of Ghana’s current and planned BO interventions and reforms against the OO Principles, which is fundamentally consistent with the EITI and FATF standards on BO disclosure. To enhance understanding and provide clarity on the ongoing and planned reforms in the country, this section contains a brief analysis of how Ghana’s BO disclosure regime is responding to the OO Principles and the EITI Requirement 2.5 on beneficial ownership, and outlines specific recommendations. These recommendations are critical to sustaining the progress already made and addressing any existing gaps.

Definition

OO Principle

Beneficial ownership should be clearly and robustly defined in law, with sufficiently low thresholds set to ensure all relevant ownership and control interests are disclosed.

- A robust and clear definition of beneficial ownership should state that a beneficial owner should be a natural person, and should cover all relevant forms of ownership (including deriving benefit from) and control, specifying that ownership and control can be held both directly and indirectly.

- There should be a single, unified definition in law in primary legislation, with additional secondary legislation referring to this definition, specifying what the definition means when applied to certain corporate vehicles, such as legal arrangements or state-owned enterprises (SOEs).

- Legislation should include a broad, catch-all definition of what constitutes beneficial ownership, coupled with a non-exhaustive list of example ways in which beneficial ownership can be held.

- Thresholds should be set sufficiently low so that all relevant individuals with BO and control interests are included in declarations. A risk-based approach should be considered to set lower thresholds for particular sectors, industries or people, depending on the policy objectives set.

- Definitions should include a clear prohibition of who does not qualify as a beneficial owner, including agents, custodians, intermediaries and nominees acting on behalf of another person qualifying as a beneficial owner.

- When the criteria to be a beneficial owner are met through two or more individuals acting jointly, each individual should be considered a beneficial owner, and each individual should be assumed to have combined ownership and control in full. Definitions should specify when joint action is assumed.

- Where no individual meets the definition of a beneficial owner, countries should require the disclosure of the name of a natural person in a senior role with managerial responsibility for the corporate vehicle in question, making clear that this person is not a beneficial owner.

EITI Requirement 2.5

- In addition to the above, the definition must also specify reporting obligations for PEPs.

Assessment

In Ghana, there are three key legislations that contain a definition for a beneficial owner, although the primary legislation is the Companies Act. The definition of a beneficial owner in all three legislations largely aligns with international best practice, however, there remain some gaps.

Table 1: Overview of the definition of beneficial ownership in Ghana

| Legislation | Definition of a beneficial owner |

|---|---|

| Companies Act, 2019 (Act 992) |

Section 383 stipulates that a “beneficial owner” means an individual: a. who, directly or indirectly, ultimately owns or exercises substantial control over a person or company; b. who has a substantial economic interest in or receives substantial economic benefits from a company, whether acting alone or together with other persons; c. on whose behalf a transaction is conducted; or d. who exercises significant control or influence over a legal person or legal arrangement through a formal or informal agreement. |

| Anti-Money Laundering Act, 2020 (Act 1044) |

Section 63 defines a beneficial owner as: a. a natural person who ultimately owns or controls the right to or a benefit from property, including the person on whose behalf a transaction is conducted; or b. a natural person who exercises ultimate effective control over a legal person or legal arrangement. |

| Petroleum Exploration and Production (General) Regulations, 2019 (LI 2359) | Regulation 80 defines a beneficial owner in the same way as it is defined in the Companies Act. |

The Companies Act provides an economy-wide regulatory framework for the incorporation of companies, and it includes measures for improving corporate governance and accountability for all companies operating in Ghana. Learning from global best practices, BO provisions in the Companies Act are inspired by experiences and lessons from other countries, including Mauritius, New Zealand and the United Kingdom. At the heart of the Companies Act is an enhanced and robust BO disclosure regime which, among others, requires the identification of beneficial owners and members of companies as well as the registration of these relationships in a central register. This includes PEPs, as recommended by the EITI Requirement 2.5. The definition of beneficial ownership, as stipulated in the Companies Act, encompasses all “companies formed in the Republic [of Ghana], whether before or after the commencement of the Act”. [5] The types of companies contemplated under the Companies Act are: a company limited by shares; a company limited by guarantee; an unlimited company; and an external company, also known as non-Ghanaian companies, all of which may be either private or public. [6]

In general, the definitions of beneficial ownership in all three legislations are relatively comprehensive, as they capture various scenarios on how one can be identified as a beneficial owner. This includes being an ultimate owner; benefiting substantially from an entity (business or a company); and exercising control over a company or a person, among other formal and informal arrangements.

Below are the positive characteristics of the existing definition of beneficial ownership in Ghana:

- All three definitions are focused on an individual (i.e. a natural person) who has ultimate interest in a company or arrangement. This presents the benefit of targeting ultimate owners to avoid the burden of documenting different layers of legal owners, even though this method has proven useful in other jurisdictions.

- The definitions are not limited to ultimate owners who are traceable in an ownership structure of a company, but also include those who have concealed their identities for either legal or illegal reasons.

- In the Companies Act, all forms of natural persons (including both domestic and foreign natural persons) are categorised as beneficial owners. In effect, the BO regime in Ghana does not exempt the disclosure of any individual from being disclosed as a beneficial owner based on their citizenship or residency status.

- Further, the definitions anticipate and emphasise all forms of ownership and control, including but not limited to shareholding, influence and control over a legal person or arrangements. An individual’s influence or control over a legal person or arrangement can be exercised through voting rights or the right to supervise final decision-making, among others.

- The definition in the Companies Act is intended as the primary definition of beneficial ownership in Ghana.

Notwithstanding the progress, the BO definitions in the aforementioned legislations have some gaps and limitations which inhibit full disclosure:

- Firstly, there are no explicit prohibitions of intermediaries, custodians, agents, etc., although the interpretation of the definition in the Companies Act [7] that emphasises direct and indirect ultimate ownership can be satisfactory to deal with these.

- The definition of beneficial ownership in the Anti-Money Laundering Act does not explicitly emphasise direct and indirect ownership and controlling interest, which is a primary feature of a robust definition of beneficial ownership. A beneficial owner of a legal entity or arrangement can be identified directly or indirectly in the form of shareholdings and voting rights or controlling rights over a company (for instance, an individual who exercises the right to supervise final decision-making or has significant influence over decisions made in a company). At the same time, a person can have ultimate ownership of a company through indirect means (either through a legal owner, shell companies, professional intermediaries, nominee and bearer shareholdings or trusts).

- The BO provisions in all three legislations do not specifically provide for thresholds in the law, however, in the Companies Act, the Registrar General is empowered to propose and enact subsidiary legislations and guidance for BO implementation. As such, Ghana has adopted a risk-based approach and agreed on thresholds (5% for high-risk sectors and 20% for all other sectors), which is reflected in Regulation 54 of the draft Companies Regulations. While the threshold selected for high-risk sectors aligns with international best practice, the 20% threshold for all other sectors is relatively high.

- Trusts are legal arrangements which are susceptible to be used by beneficial owners to hide their identities in order to indirectly control or own interest in a legal entity. There is growing evidence of misuse of such complex structures in the context of criminal and illicit behaviours, including escaping international sanctions and funding terrorist organisations. However, there is no legislation for trusts in Ghana, even though the Companies Act does not prevent individuals from holding shares in trusts for another person(s), especially in the case of debenture holders. [8] This is common with individuals who hold shares in trusts for minors.

Table 2: Assessment of beneficial ownership definitions against best practices

| Key aspects of definition | Companies Act, 2019 | Anti-Money Laundering Act, 2020 | Petroleum Exploration and Production (General) Regulations, 2019 |

|---|---|---|---|

| Does the definition specify that a beneficial owner must be a natural person? | Yes | Yes | Yes |

| Is the definition explicit that a beneficial owner must be an individual who ultimately owns or controls a company? | Yes | Yes | Yes |

| Does the definition specify direct and indirect forms of ownership and control? | Yes | No | Yes |

| Does the definition include interest via ownership and control? | Yes | Yes | Yes |

| Does the definition include forms of economic interests? | Yes | Yes, though not explicitly on all forms of economic benefit (other than property and transactions) | Yes |

| Does the law specify thresholds? | No, but it empowers the Minister to make further regulations to guide implementation | No, but FATF-style legislations are guided by recommendations which suggest no more than 25% | No |

| Does the definition include SOEs, in line with the EITI Requirement 2.5? | No | No | No |

| Does the legislation require the collection of data on PEP status? | Yes | No | Yes |

Recommendations

- To make it easier for the public to identify a beneficial owner, the draft regulations should contain a non-exhaustive list of scenarios or example ways of how BO interests can be held. The categorisation should be routinely reassessed based on updated risk assessments. Ghana should publish the draft regulations providing further clarification on the determination of sectors to be high risk and low risk.

- The ORC may wish to consider reducing the BO reporting thresholds for low-risk sectors to ensure maximum disclosure of ownership and control. The 20% threshold for all other sectors is relatively high.

- The application of sector-specific thresholds should be well articulated and published in the draft Companies Regulations in order to ensure effective implementation and prevent stakeholders from leveraging on gaps in the BO regime in an attempt to avoid BO disclosure.

- Ghana should consider including BO disclosure requirements in the impending Trust Bill to ensure comprehensive BO disclosure implementation.

Coverage

OO Principle

Disclosure requirements should comprehensively cover all relevant types of entities and arrangements.

- Disclosure requirements should apply to all types of corporate vehicles, unless reasonably exempt.

- Any exemptions from full declaration requirements should be clearly defined and justified against policy aims, and they should be reassessed on an ongoing basis.

- Exemptions from disclosing beneficial ownership may be granted when an entity or arrangement is already disclosing sufficient information and this information is accessible through alternative mechanisms (e.g. for publicly listed companies (PLCs) listed on exchanges with sufficient disclosure requirements).

- Entities and arrangements exempt from disclosing their beneficial ownership should still be required to make declarations, including the basis for their exemption.

- All exemptions should be interpreted narrowly.

Assessment

Comprehensive coverage of different forms of corporate vehicles in BO disclosures is critical in guarding against exploitation of potential gaps in BO regimes. Therefore, BO requirements should comprehensively cover all types of ownership and control structures (direct and indirect); forms of natural persons (domestic and foreign); and entities (SOEs and PLCs) to avoid gaps that could potentially be exploited. SOEs and PLCs are required to disclose their BO information in Ghana, even though the particulars of the data required is different from that of unlimited companies and companies limited by shares or guarantee. Based on the OE technical team’s assessment, the current BO regime in Ghana is quite comprehensive. This is because, currently, all entities [9] and companies duly registered or incorporated in Ghana are obliged to declare the ultimate beneficial owner(s) at the top of the ownership chain. Also, the current regime stipulates that BO information must be collected for all sectors of the Ghanaian economy, although, with different ownership thresholds.

Based on Ghana’s commitments under various international protocols (the FATF Recommendations, the EITI Standard, the EU AMLDs, GIABA, the London Anti-Corruption Summit, etc.), the BO regime was also set up to be all encompassing in order to satisfy various requirements. As a result, the BO regime was well consulted and received comments from different sectors with different backgrounds, including extractives, banking, legislators, insurance, law firms and the company registry. Therefore, the comprehensive nature of Ghana’s regime was largely achieved as a result of its strong commitment to honouring international treaties and conventions, along with the broad multi-stakeholder consultation process used in developing relevant BO laws and regulations. Under the Companies Act, there are no exemptions for any type of entities; however, where the legal owner of a company is a PLC or an SOE, the requirements for complying with BO reporting differs slightly from those of an individual beneficial owner. The next section provides details on the reporting requirements for SOEs and PLCs.

Not all types of legal entities and arrangements that exist and operate in Ghana are required to make BO declarations by the Ghanaian jurisprudence. For example, trusts, which are a type of legal entity, are not contemplated or legislated for under the Companies Act. It is understood that a Trust Bill is being developed to focus only on arrangements like trusts, but not much progress has yet been made. It is expected that a Trust Commission will be established by the same legislation as the main agency to deal with the registration and regulation of trust arrangements in Ghana.

Also, although the draft Companies Regulations do not specify any class of people or group to be exempted, any individual with anticipated risk can apply for and provide evidence for exemptions. Specifically, Regulation 58 states that an individual can apply for exemptions under the following circumstances:

- Threat to the physical safety of an individual or the physical safety of their family members, especially the threat of serious injury or death

- Attack against an individual’s home or place of work

- Kidnap of an individual or their family members

- Blackmail or extortion against an individual or their family members

- Significant financial loss through criminal activity

Recommendations

- Ghana should fast-track the development and passage of the Trust Bill to ensure that a legislative framework for the regulation of both domestic and foreign trusts exists. This legislative framework should include a BO disclosure requirement for trusts. Considering the nuances of the corporate structure of trusts, the ORC should provide clear and sufficient guidance on the disclosure requirements for trusts.

- Where an exemption is granted to an applicant, the ORC should indicate in its database and the central register that an exemption has been granted, pursuant to the draft Companies Regulations. Where possible, an indication of the grounds upon which the exemption was granted should be indicated.

Detail

OO Principle

BO declarations should collect sufficient detail to allow users to understand and use the data.

- Information should be collected about:

- the beneficial owner(s);

- their status as beneficial owner(s) (i.e. the means through which ownership or control is held); and

- the declaring corporate vehicle and individual submitting the declaration.

- Information should be collected in a standardised way through online forms, with clear guidance that facilitates compliance.

- Sufficient information should be collected to be able to unambiguously identify people, entities and arrangements, using clear identifiers, and to enable the accuracy of the data to be verified to a reasonable level.

- Information required to be disclosed should be enumerated in law and limited to what is necessary to achieve the policy objective, with a clearly stated purpose and legal basis.

- Where beneficial ownership is held indirectly through multiple entities or arrangements, or ownership or control are exerted formally or informally through another natural person, sufficient information should be collected to understand full ownership chains.

- Where beneficial ownership can be expressed as a percentage, for example, when held through shares, absolute values should be collected.

- Information about any state ownership or control (domestic or foreign) and individuals holding positions of control specific to SOEs (e.g. senior managing officials) should be collected.

Assessment

In instituting a robust and effective BO regime and collecting relevant data about its beneficial owners, the declaring company facilitates correct use of data in determining which individuals and entities, including companies, a particular declaration is about. Additionally, collecting and publishing the means of ownership and control enables users to understand how beneficial ownership is exercised in an entity.

In Ghana, declaration forms [10] from the ORC (which are currently paper based) are used for the collection of relevant particulars on beneficial owners, their companies and their ownership and control methods. Even though the ORC has yet to use an online data collection form, the department plans to move fully online.

A significant observation is the fact that the declaration forms issued by the ORC include guidance targeted at data accuracy. Each company, regardless of its type, form or sector, is expected to complete a BO declaration form; this allows the ORC to initially capture the number of beneficial owners of such a company. To enhance BO data collection, the ORC uses three different forms. This also helps to avoid any confusion on the disclosure requirements for private companies, PLCs and government-owned companies. The aim is to ensure that the information peculiar to the corporate structure of PLCs and SOEs is unambiguously captured. Yet, disclosing the beneficial owners of SOEs has been met with some resistance. In practice, stakeholders highlighted concerns around unwillingness by leadership of SOEs to disclose their details as legal or beneficial owners.

With respect to the extent to which sufficient detail is collected to identify the beneficial owners, our assessment revealed that the BO forms contain information relevant to identifying the beneficial owners as well as information on how control and interests are held. The forms also make provision for disclosing cases where the beneficial owner is a PEP, in line with the Companies Act and as recommended by the EITI Requirement 2.5. With support from the OE team to improve the design and content of the forms, the specific ways control can be exercised (captured in the draft Companies Regulations) has been incorporated in the forms. This will enable declaring persons and companies to capture accurate information on the nature of interest each beneficial owner has in the reporting company. Also, by law, the unique identifiers of both domestic and foreign entities, as well as legal arrangements captured by the declaration form, facilitate the matching of declarations about the same people, while making it easier to distinguish different individuals with similar names.

| Details of entities | Domestic legal entity | Foreign legal entity |

|---|---|---|

| Clear identifiers for entities (e.g. tax identification number (TIN) or unique identifier for incorporation documents for external companies) | Yes | Yes |

| Entity name (full name) | Yes | Yes |

| Entity address | Yes | Yes |

| Country of incorporation | Yes | Yes |

~

| Details of individuals | Domestic beneficial owner | Foreign beneficial owner |

|---|---|---|

| Clear identifiers for people (e.g. TIN or national ID number) | Yes | Yes |

| Full name | Yes | Yes |

| Alternative names | Yes | Yes |

| A contact address, including country of residence | Yes | Yes |

| Date of birth | Yes | Yes |

| Nationality/ies | Yes | Yes |

| PEP status | Yes | Yes |

Another commendable key feature in Ghana’s BO declaration forms is the use of absolute figures instead of ranges, which enhances the accuracy of data collection. The declaration of ownership and control by the central government or institutions acting on its behalf was also a major finding of this study. The table below shows the extent to which the state, per the legal provisions of Ghana, expects BO declaration:

| Ghana | Yes/No |

|---|---|

| The state agency which owns or controls the entity | Yes |

| The name, role and address of the government representative | Yes |

| The nature of ownership or control | Yes |

| Whether ownership or control is direct or indirect | Yes |

The collection of sufficient details with the right data fields using structured and easy-to-use declaration forms can assist with the implementation of BODS. To ensure maximum information is collected on beneficial owners and their entities, the particulars of a beneficial owner collected by the ORC goes beyond the requirements from the FATF Recommendations and the EITI Standard. Particulars collected under the BO forms include:

(i) Full name and any former names

(ii) TIN

(iii) Date of birth

(iv) Place of birth

(v) Telephone number

(vi) Nationally accepted identity card number

(vii) Residential address and digital address

(viii) Service address

(ix) Email address

(x) Nature of the interest, including method(s) by which ownership or control are exercised and details of the legal, financial, security, debenture or informal arrangement giving rise to the beneficial ownership

(xi) The percentage of the BO interest, the nature of control, or both

(xii) Declaration on whether the natural person meets the definition of a PEP

Recommendations

- The ORC should work to improve BO data disclosure compliance by standardising BO data collection through an online platform. It is understood that migrating BO data collection online is one of the ultimate objectives of the ORC, however, its implementation is slow.

- The ORC and partners may consider strengthening engagement, sensitisation and capacity building for SOEs and relevant stakeholders to ensure comprehensive and accurate disclosure of ownership information by SOEs.

- In line with the EITI Requirement 2.5, the GHEITI MSG must routinely carry out a review and disclose any significant gaps or weaknesses in reporting on BO information, including any entities that failed to submit all or some BO information.

Central register

OO Principle

Data should be collated in a central register.

- BO disclosures should be collated and held within a central register.

- The central register should be an authoritative source of BO information, with a designated responsible body.

Assessment

In Ghana, in line with global best practices and standards, BO data is collated and stored in a central register. A centralised register ensures that people and state authorities are able to access BO data from a central location in a standardised format, which eliminates practical barriers in accessing and using BO information.

In the development process of Ghana’s central register, the ORC initially contracted an information technology (IT) firm, GCNet, to develop the central register with a BO component. The register was expected to include a client portal where entities could complete an online BO form. However, even though GCNet has handed over the central register, it has yet to roll out the portal, and it is the OE team’s understanding that the IT firm’s contract has now expired. As it stands, there is currently an online provision to access BO information, but there have been long-standing technical challenges with the payment platform, so that option has largely been inactive. People can request BO information manually, which normally takes between three days and two weeks, depending on the nature and number of requests and the availability of information. The ORC’s current capacity (technical and financial) may be satisfactory to maintain the central register, but it is not sufficient to fast-track implementation of the customer portal. It is understood that the International Finance Corporation is currently supporting the ORC to develop new software with enhanced features to allow for a customer online portal and full digitisation of company registration, incorporation and other filings, including beneficial ownership. [11] This is expected to grant swift online access, even though payment will still be required for access.

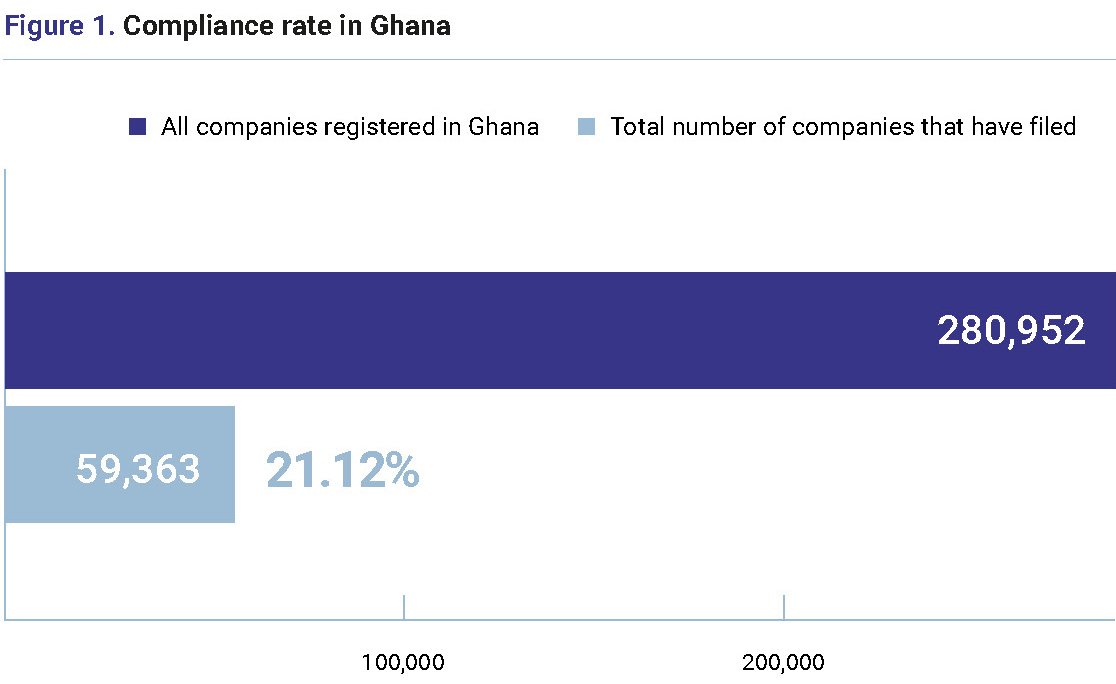

As is the trend in other jurisdictions, the ORC has been very successful with collecting BO disclosures from newly registered companies compared to legacy companies. The compliance rates are represented below:

Figure 1. Compliance rate in Ghana

Recommendations

- Given the level of progress Ghana has made with establishing an enabling legislative and regulatory environment for the effective disclosure of BO information and the ongoing efforts to build the capacity of the ORC’s staff, a fully functional, public-facing BO portal where declarations can be digitised and access to BO information made easier will be a welcome development by stakeholders. Of course, such an undertaking has financial and technical implications, and the OE programme is committed to supporting the ORC in its development of a system that is fit for purpose and will make declarations more efficient.

- Progress has been made in developing, updating and using the paper-based BO forms, particularly through the support of the OE programme. Ghana should consider transitioning to a digital form. As the ORC makes progress to develop a digital platform for reporting, the OE programme will be ready to provide technical support to ensure that the new ORC digital form is compatible with international best practices, such as BODS. BODS is a data standard that provides a structured data format, along with guidance for collecting, sharing and using BO data.

- In the interim, the ORC may consider adopting a model declaration form (in Microsoft Excel) that can be concurrently used alongside the paper-based version. The EITI and OO have provided comprehensive guidance on how to do this.

- The ORC should ensure adequate consultation is made between the new software developer and relevant stakeholders (including the OE programme) to ensure BO data disclosure software requirements align with best practice and service the needs of the data providers and users.

Access

OO Principle

Sufficient information should be accessible to all data users without undue restrictions.

- Sufficient information should be accessible to each data user group that can contribute to meeting intended policy aims.

- All government users and additional user groups whose access is justified to meet specific policy aims should have direct and rapid access to the data they require, on a per-record basis (searchable by both the name of the corporate vehicle and the beneficial owner) and as bulk data.

- The public should have access to a clearly defined subset of information that is sufficient for them to understand and meaningfully use the data, free of charge.

- Data should be available without barriers to access, search, use and share the data, such as identification or registration requirements, and restrictive search functionality or licensing.

- The publication of information should be proportional to the infringements on privacy, by clearly establishing a broad purpose and legal basis, in line with privacy and data protection legislation, and by understanding and mitigating potential negative effects of the publication of data.

- Disclosure regimes should permit withholding the publication of certain data on a case-by-case basis as part of a protection regime to mitigate disproportionate risks to personal safety. The grounds for withholding the publication of any data should be clearly defined, proportionate, fairly applied and published.

- Where information is exempt from disclosure to the register, or withheld from publication, the exemption should be clearly defined, justified and narrowly interpreted, and the publicly available information should note the reason information has been exempted from disclosure or withheld from publication.

Assessment

Ideally, all user groups should have access to the extent of information that is relevant to achieving a country’s policy aim. Having rapid access to BO data does not only readily provide BO information about individuals and companies to journalists, law enforcement and the general public, but it also increases the data’s utility, as systemic barriers such as payments, registration and identification are eliminated. The BO register in Ghana is publicly accessible, but it is not freely accessible. The following accessibility options have been detailed in the draft Companies Regulations:

- LEAs will have free access to BO information in the register.

- Competent authorities (as defined in the Anti-Money Laundering Act) will have free access to all BO information in the register.

- The public will have access to limited BO information at a prescribed fee of GHC 25 (equivalent to USD 2.50) for each company’s BO details. Information accessible to the public will include the name of the beneficial owner, their business address, the nature of interest and the company details.

According to the ORC, the format of accessibility is both manual (paper-based form) and electronic (PDF file). With regards to data sharing, the FIC, through a goAML application, [12] has piloted API access between the ORC and other LEAs and competent authorities [13] on legal owners’ information access. It is expected that similar arrangements will be adopted for BO data access between the ORC and LEAs and competent authorities. Further, although BO data is not freely available to the public, there have been advanced discussions for exceptions to be made for non-state accountability actors, such as CSOs, even though this has not been formalised in the draft Companies Regulations, nor in administrative procedures.

With respect to the enablers and constraints to making sufficient BO data available to relevant data users, our assessment showed that even though Section 373 (3) (c) of the Companies Act requires an electronic version of the register to be open to the public, in line with open data best practices, the slow progress in the development of an online portal may hinder the smooth implementation of this provision. It is also worth noting that before the institutionalisation of a BO regime in Ghana, the ORC charged a fee for public request and accessibility for legal ownership information; this formed a significant part of the department’s internally generated funds. The same arrangements are now being maintained under the Companies Act and applied to BO information disclosure.

However, Ghana has taken steps to ensure that the publication of BO data is in line with relevant data protection and privacy regulations. Section 66 of Ghana’s Data Protection Act (2012) exempts the Companies Act from non-disclosure of personal information, even though disclosure to the public is expected to be in data protection guidelines. [14] Also, information about the residential address and the full date of birth of beneficial owners is withheld by the ORC, and this is in keeping with the provisions of Ghana’s Data Protection Act.

Recommendations

- The ORC should consider alternative avenues for ensuring system sustainability without hindering the ability of relevant data users to freely access a subset of BO data. In the short term, this may involve undertaking an informed cost-benefit analysis with clear recommendations to guide a transition towards an open, free public register. A cost-benefit analysis will enable the ORC to better understand the financial implications of granting free access to a subset of BO data, and it will inform conversations and negotiations with international donors and partners. This is an area of implementation where the OE programme has planned to support the ORC.

- As an interim measure, the GHEITI MSG should consider publicly disclosing ownership information of companies operating in the extractive sector, in line with the EITI Standard Requirement 2.5. In the long term, the ORC may want to consider ways to address the barrier to free and open public disclosure of BO information, and it may leverage support from the OE programme on how to address this.

Structured data

OO Principle

BO information should be collected, stored and shared as structured and interoperable data.

- BO data should be collected, stored and shared as structured data in a way that can be used to identify all parties and describe the full range of relationships that can exist in a BO declaration, using clear identifiers.

- Data should conform to a specified data template and format, with an appropriate licence and sufficient documentation, including a publication policy.

- Sufficient information should be captured to create an auditable record, including dates and reasons for specific changes.

- Data should be available digitally, including in machine-readable formats.

- Data should be auditable by users by making it available in a range of ways, including in a browsable format, a bulk format, on a per-record basis and via an API.

Assessment

In data management, the utility of data is enhanced when it is available in a structured format and can easily be retrieved for analysis purposes. Well-structured BO data facilitates analysis and enhances its utility in exposing cross-border networks of illicit financial flows.

Ghana’s current BO register, though at its early stages, has the potential to publish data in bulk and interoperable format, consistent with BODS. However, in practice, BO data is not easily accessible online due to protracted software challenges faced by the ORC. Further, the current BO software has the potential to generate data in bulk but, in practice, this has not been available to public data users.

Currently, BO data is available in machine-readable digital (comma-separated values (CSV)) format, and the ORC plans to release BO data to users in the same format once their online portal is fully operational. Based on the design of the central register and software requirement specification documents, it is expected that the central register will be able to create reports in various formats, including structured data formats (such as CSV). However, more steps need to be taken to align the current format of data collection with BODS.

According to the Registrar, the ORC is expected to roll out new software in 2023, and they will ensure adequate consultation is conducted to allow for integration of international best practices on the structure of BO data.

Recommendations

- As the ORC is set to develop new software in 2023, it should consider the adoption of a structured data format consistent with BODS, such as JavaScript Object Notation (JSON) format.

- The ORC should consider undertaking a gap assessment of the existing data structure, consistent with BODS, to provide an appropriate baseline and identify key gaps to form a basis for the new software. The OE team will be available to support this system’s assessment exercise. This should be a priority activity for 2024, as it will provide the ORC with a better understanding of what the system challenges are and create a clearer picture of what specific type of support is required to improve the ORC’s data collection. This is particularly important given the ORC’s plan to put in place new software, as assessing the current software might offer useful lessons to inform the development of the new one.

- Ghana’s BO legislation requires electronic BO information to be published in line with open data practices, however, there is no practical guidance on how to implement the open data provision. The ORC should institute practical guidance to help with the publication of BO data in a well-structured and open data format. Under the new software, open data requirements should be integrated into the design in order to satisfy the legal provision on open data formats.

Verification

OO Principle

Measures should be taken to verify the data.

- Measures should be taken to verify information about:

- the corporate vehicle(s);

- the beneficial owner(s);

- their status as beneficial owner(s) (i.e. the means through which ownership or control is held); and

- the individual(s) making the declaration.

- Mechanisms to verify the information when it is submitted should include:

- ensuring values conform to known and expected patterns;

- ensuring values are real and exist by cross-checking information against existing authoritative systems and other government registers; and

- checking supporting evidence against original documents.

- After information has been submitted, the responsible agency should proactively check the information to identify potential errors, inconsistencies and outdated entries, and query, remove or update the data where necessary. The responsible agency should have the legal responsibility, mandate and powers to do so.

- Mechanisms should be in place to raise red flags, both by requiring parties dealing with BO data to report discrepancies and by setting up systems to detect suspicious patterns based on experience and evidence.

- Ownership types that are difficult or impossible to verify (e.g. bearer shares) should be prohibited.

Assessment

Data quality and authenticity in a BO regime is critical to ensuring stakeholders have confidence and trust in a register. To ensure BO data reflects the true identity of the ownership and control of companies and entities, innovative data verification measures – at each stage of the data management cycle – are necessary.

Verification at the point of submission: In Ghana, data verification measures are fairly comprehensive. At the point of submission, BO information is cross-checked with other state registers, including Ghana Revenue Authority data and National Identification Authority data, for first-level authentication and verification. BO information submitted by companies is also cross-checked with the Ghana National Card database to confirm that the particulars of a beneficial owner (including name, date of birth, residential address, nationality/ies and national ID details) conform with existing data sets. Data entry clerks at the ORC also check the data submitted to ensure that it conforms with expected data patterns; is realistic; and is consistent with valid means of identification provided. Further, information for each beneficial owner who has a TIN issued by the Ghana Revenue Authority is systematically integrated with the ORC information, and it automatically verifies data at the point of submission. For foreign natural persons, a national identity number, passport number or other national identification card or proof of identity is required.

Verification after submission: Regarding the tools and methods used in verifying names, entities and ownership and control, Ghana’s current practice is not adequate, as there are gaps. Currently, there are no verification systems to cross-check BO data with other registers (such as the FIC’s suspicious transaction lists, Ghana card, driving licence, birth and death registry, etc.) after submission.

As per Section 373 (3) and (8) of the Companies Act, the ORC is expected to develop regulations and internal procedures for verification of information entered into the central register, including BO information. These procedures are expected to provide technical assistance to the ORC to review sampled applications and request for further information or check potential errors for correction. Further, these procedures are expected to help build coordination between the ORC, other LEAs and competent authorities to report inconsistencies with BO declarations and other suspicious information. In the event of any discrepancies, per the draft Companies Regulations 46 (3) (yet to be enacted), the ORC is expected to conduct investigations into any reported discrepancies and further request the entity to submit accurate information; however, in practice, the ORC has not received any reported discrepancies. Finally, the ORC is supposed to inform the reporter of the outcome of the investigations within 28 days of receiving the report, but the ORC is yet to establish systems to implement these processes.

Verification of BO information has been extensively discussed at the ORC, but it is yet to be implemented. A key setback over the years is the ORC’s technical and financial capacity to design a functioning verification procedure and at the same time set up systems to implement it. To improve data verification in Ghana’s BO regime, it is important to assess the current capacity and internal structures of the ORC in order to effectively set up and implement a robust verification regime. Verification measures after submission are yet to be fully designed (including protocols between the ORC and other agencies, discrepancy report forms, etc.).

Recommendations

- To improve the quality of the data collected, the ORC should ensure that the data collection form (paper-based or online) is clear and has sufficient guidance for companies completing the form. When the online system is being developed, the e-declaration form should contain drop-down menus as opposed to free text fields to minimise data entry errors.

- To improve BO verification, the ORC, in collaboration with other relevant agencies (competent authorities and LEAs), should design robust verification processes, systems and processes to check for the accuracy, reliability and validity of BO information. This should include: the establishment of a team within the ORC to ensure compliance of verification measures (both pre- and post-submission of BO information); a clear process to allow for external verification; and reporting of inaccuracies, as well as protection of the identities of individuals who report discrepancies.

- In line with the EITI Standard Requirement 2.5(c), the GHEITI MSG should consider undertaking/collaborating on a routine review of the existing mechanisms for assuring the reliability of BO information. This should include a review of the comprehensiveness and reliability of ownership information disclosed by PLCs in stock exchange filings.

Up-to-date and historical data

OO Principle

Data should be kept up to date and historical records maintained.

- Initial registration and subsequent changes to beneficial ownership should be legally required to be submitted in a timely manner, with information updated within a short, defined time period after any changes occur.

- Data should be legally required to be periodically confirmed as correct, on at least an annual basis.

- All changes in beneficial ownership should be legally required to be reported.

- Information should be kept for a reasonable and specified number of years, including for dormant and dissolved corporate vehicles.

Assessment

Updating data regularly is critical to having an accurate BO database and increasing trust in data usage. It reduces tendencies of companies disguising short-term changes in beneficial ownership, while making it more difficult for individuals and entities to circumvent established disclosure procedures. In the BO regime in Ghana, the ORC mandates entities to make their first declarations in a timely manner, which is consistent with international best practices. All entities were required to have made their submissions by the end of 2021, even though the initial deadline was June 2021. This was determined based on the ORC’s existing windows for filing annual returns – January and June of each year. With respect to an entity updating their declarations within a specified period of time after a change to BO information, the Companies Act requires the following:

- Annual return filings (Section 126 of the Companies Act): Each entity can submit updates of BO particulars during annual returns each year.

- Amendments (Section 35 (2) (b) of the Companies Act): Where there are changes in the composition of the beneficial ownership of an entity, the entity will update its BO register within 28 days of the changes and update the central register (the ORC) within 28 days of its internal update.

Also, during annual returns, entities will be given BO forms to confirm whether BO information is accurate and/or there have been any changes in their BO register. This is to ensure that their BO information remains accurate on at least an annual basis. Currently, filing updates to BO information can be completed within 24 hours, as long as all requirements are met.

Recommendations

- The ORC should consider broadening regulations to capture specific data retention rules that encourage historical storage of BO data, which is valuable for investigative and due diligence processes, among others.

- Under the new data software expected to be rolled out in 2023, the ORC, with support from the OE programme, should work to develop software with the capacity to store and produce the history of BO data in chronological order, including when the data was changed and what changes were made.

Sanctions and enforcement

OO Principle

- Effective, proportionate and dissuasive sanctions for noncompliance should exist and be enforced.

- Effective, proportionate, dissuasive and enforceable sanctions should exist for noncompliance with disclosure requirements, including:

- non-submission;

- late submission;

- incomplete submission;

- incorrect submission;

- deliberately false submission; and

- persistent noncompliance; as well as other obligations related to the disclosure regime.

- Sanctions should cover all the persons involved in declarations and key persons of the corporate vehicle, including the beneficial owner(s); declaring person; company officers; and the declaring corporate vehicle.

- Sanctions should include both administrative and criminal sanctions.

- In order to be dissuasive and not to be seen as merely the cost of doing business, for noncompliance, financial sanctions should be set sufficiently high and be complemented by non-financial sanctions.

- Sanctions and their enforcement should be effectively operationalised, including by clearly determining which authority is responsible to enforce sanctions; ensuring it has sufficient resources, legal mandate and powers to enforce sanctions; and automating sanctions where possible.

Assessment

Instituting appropriate, proportionate and fair sanctions and enforcement mechanisms in BO regimes facilitates compliance with disclosure requirements (particularly for key natural persons, such as PEPs and foreign entities), and increases the quality and utility of BO data. In Ghana, there are draft regulations that cover appropriate sanctions, which are applicable to the declaring entity; the person making the declaration; the registered officers of the company; and the beneficial owners. Ghana’s sanctions can be partially described as proportionate, dissuasive and enforceable, but they exist for all types of noncompliance, including not submitting a BO declaration, late submission, incomplete submission or falsifying information. In line with provisions of the Sanctions and enforcement principle, Ghana’s sanction regime consists of both monetary and non-monetary penalties. As per the draft Companies Regulations, monetary sanctions for administrative breaches include 1,000 penalty units (equivalent to GHC 12,000 or USD 1,000), while non-monetary sanctions include imprisonment for a minimum of one year and a maximum of two years.

Ghana has put in place an enforcement mechanism, while relevant state agencies have received some capacity training to improve enforcement and the application of sanctions. This notwithstanding, the level of de facto compliance with the disclosure requirements remains less than optimal. This may be partly attributed to the fact that Ghana currently does not publicly publish data on noncompliance with declaration requirements – an international best practice which serves as a check on noncompliance. According to the ORC, the deadline it sets to apply penalties to entities that fail to comply has pushed most entities to disclose their BO information. Currently, new registrations cannot be completed if an entity does not submit BO forms; however, the compliance rate with existing entities is slow and, according to the ORC, may be below 50%.

Recommendations

- In addition to financial and criminal sanctions, the ORC should consider other non-financial sanctions, such as making compliance with BO a condition precedent to annual returns filing; requests for certificates of good standing; and any other corporate filing. Also, the sanctions should apply to beneficial owners, declaring persons, company officers and the companies, and they should cover all types of compliance obligations, such as non-submission of BO information, late submission and incomplete submission.

- Ghana should conduct a capacity gap assessment for ORC staff and deliver appropriate capacity-building initiatives to enhance their BO administration, including on enforcing sanctions for noncompliance.

- Other regulators, such as the PetCom, the MinCom and the PPA, should also institutionalise beneficial ownership by making it part of their licensing or contracting requirements. This could ensure that every company dealing with those agencies is compliant with BO reporting requirements.

- The ORC should make data on noncompliance with declaration requirements publicly available.

Footnotes

[5] Section 1(2) of the Companies Act, 2019 (Act 992). Retrieved from: https://rgd.gov.gh/docs/Act%20992.pdf.

[6] Section 7 of the Companies Act, 2019 (Act 992). Retrieved from: https://rgd.gov.gh/docs/Act%20992.pdf.

[7] Section 383 of the Companies Act, 2019 (Act 992), First Schedule, p. 301. Retrieved from: https://rgd.gov.gh/docs/Act%20992.pdf.

[8] Section 95 of the Companies Act, 2019 (Act 992). Retrieved from: https://rgd.gov.gh/docs/Act%20992.pdf.

[9] Under Section 7 of the Companies Act, the entities registrable are (a) a company limited by shares; (b) a company limited by guarantee; (c) an unlimited company; and (d) external company. See: https://rgd.gov.gh/docs/Act%20992.pdf.

[10] Registrar General’s Department (no date), “Downloadable Forms – Beneficial Ownership Forms”. Retrieved from: https://ORC.gov.gh/forms.html.

[11] Ghana Web (2022), “New software to be deployed for business registration in 2023 – Registrar of Companies”. Retrieved from: https://www.ghanaweb.com/GhanaHomePage/business/New-software-to-be-deployed-for-business-registration-in-2023-Registrar-of-Companies-1594022.

[12] goAML is an anti-money laundering application. It is a fully integrated software solution developed specifically for use by financial intelligence units, and is one of the United Nations Office on Drugs and Crime’s strategic responses to financial crime, including money laundering and terrorist financing. It helps to integrate multiple databases to improve data sharing. See: https://unite.un.org/goaml/.

[13] Such as, for example, the FIC, the Economic and Organised Crime Office, the Ghana Police Criminal Investigations Department and the National Investigation Bureau.

[14] Raymond Codjoe, OneTrust DataGuidance ( 2023), Ghana – Data Protection Overview. Retrieved from: https://www.dataguidance.com/notes/ghana-data-protection-overview.