Updated January 2023

Effective, proportionate, and dissuasive sanctions for noncompliance should exist and be enforced

- Effective, proportionate, dissuasive, and enforceable sanctions should exist for noncompliance with disclosure requirements, including:

- non-submission;

- late submission;

- incomplete submission;

- incorrect submission;

- deliberately false submission; and

- persistent noncompliance;

as well as other obligations related to the disclosure regime.

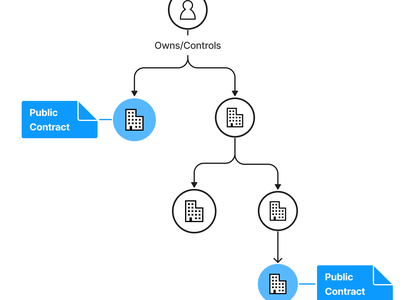

- Sanctions should cover all the persons involved in declarations and key persons of the corporate vehicle, including the:

- beneficial owner(s);

- declaring person;

- company officers; and

- the declaring corporate vehicle.

- Sanctions should include both administrative and criminal sanctions.

- In order to be dissuasive and not to be seen as merely the cost of doing business, for noncompliance, financial sanctions should be set sufficiently high and be complemented by non-financial sanctions.

- Sanctions and their enforcement should be effectively operationalised, including by clearly determining which authority is responsible to enforce sanctions; ensuring it has sufficient resources, legal mandate, and powers to enforce sanctions; and automating sanctions where possible.

Having adequate sanctions in place, and enforcing these effectively, helps to drive up compliance with disclosure requirements and increase the quality and utility of the data. It is also a requirement of the Financial Action Task Force (FATF) Recommendations. Including sanctions against the beneficial owner, registered officers of the company, and the corporate vehicle making the declaration helps ensure that the deterrent effect of sanctions applies to all the key persons, entities, and arrangements involved in the declaration. This helps incentivise compliance from the beneficial owner, registered officers, and broader stakeholders involved in the governance and management of the corporate vehicle.

Sanctions can only act as an effective deterrent if they are enforced. To do this, relevant agencies need both the legal mandate and adequate resources to identify suspected noncompliance, investigate appropriately, and issue sanctions. Sanctions should include both financial and non-financial penalties, which can cover certain business-related rights, such as not being able to incorporate a company or not being paid out dividends from shares. Jurisdictions have taken a number of approaches that have a strong potential to contribute to effectively operationalising sanctions and their enforcement.