Beneficial ownership in law: Definitions and thresholds

Defining beneficial ownership

The Financial Action Task Force (FATF) defines a beneficial owner as “the natural person(s) who ultimately owns or controls [a legal entity,] and/or the natural person on whose behalf a transaction is being conducted.” [3] In other words, the beneficial owner is the person or persons who benefit from or exercises control over a legal vehicle. The concept of a legal owner of a company is slightly different in that it refers to the owner whose name appears on the shares (see Figure 1). For many ordinary companies not set up for illicit purposes the beneficial and legal owners of a given entity are often the same person, but this is far from always being the case.

Whilst direct forms of ownership and control – for instance, through the holding of ordinary shares – are relatively straightforward, there are also more complex ways in which natural persons can have indirect ownership or exercise indirect control over legal entities. These can include through ties of kinship or other types of affiliation, shareholder agreements, nominee shareholders, and convertible stock.[4] Similarly, someone may derive substantial economic benefit from a legal entity – for instance, through the enjoyment of assets – without holding any formal ownership shares. The World Bank highlights the importance of including indirect ownership when defining BO, arguing that BO should be understood as a material, substantive concept – referring to de facto control over a corporate vehicle – and not a purely legal or quantitative definition. [5]

Defining what constitutes indirect ownership and control is the main challenge in legal definitions. Control of a corporate vehicle can be exercised in many different ways, including through ownership, contractual, or informal arrangements. [6] Additionally, the ways in which an individual can directly or indirectly control or own a business will depend on the specific legal context in a country, including via its company, inheritance, and tax laws, which can all provide other ways for individuals to derive benefits from a company.

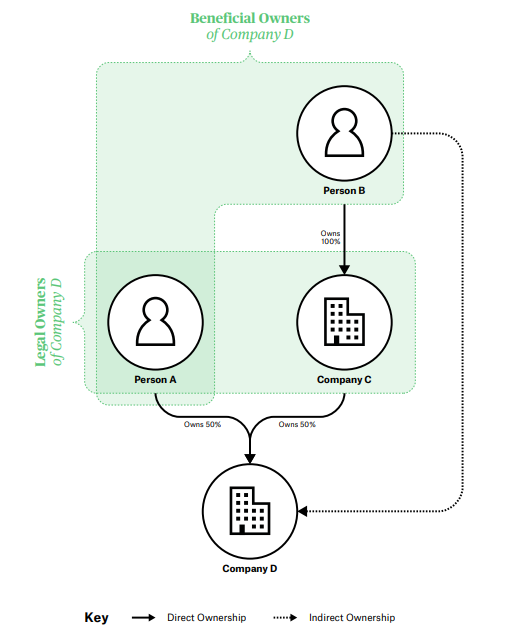

Figure 1. Types of Ownership

Person A and Company C are the legal owners of Company D. Person B is the legal owner of company C. Person A and Person B are the beneficial owners of Company D. Person A exercises his/her ownership directly, while Person B exercises his/her ownership indirectly through Company C. Company C cannot be a beneficial owner as it is not a natural person.

Therefore, the best way for BO to be defined in law is to develop a definition that encompasses BO as a substantive concept, that is clear, comprehensive and enforceable. Another challenge to identifying best practice is that comparatively few jurisdictions have fully implemented BOT, and there are even fewer where the legal definition of BO has been tested in court (the case of Slovakia, outlined in Box 2, is a notable exception).

For more conventional ways of exerting ownership and control, such as holding direct or indirect shares or voting rights, lawmakers often use percentage thresholds as a means to identify BO. Setting such thresholds too high can present a significant loophole, as will be discussed later in this briefing.

Footnotes

[3] Financial Action Task Force Guidance, “Transparency and Beneficial Ownership”. October 2014. Available at: http://www.fatf-gafi.org/media/fatf/documents/reports/Guidance-transparency-beneficial-ownership.pdf [Accessed 29 September 2020].

[4] Transparency International G20 Position Paper, “Beneficial Ownership Principles”. May 2015. Available at: https://www.transparency.org/files/content/activity/2015_ TI_G20PositionPaper_BeneficialOwnership.pdf [Accessed 29 September 2020].

[5] World Bank, “The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About It”. 2011. Available at: https://star.worldbank.org/sites/star/files/puppetmastersv1.pdf [Accessed 29 September 2020].

[6] Ibid.