Beneficial ownership transparency and listed companies

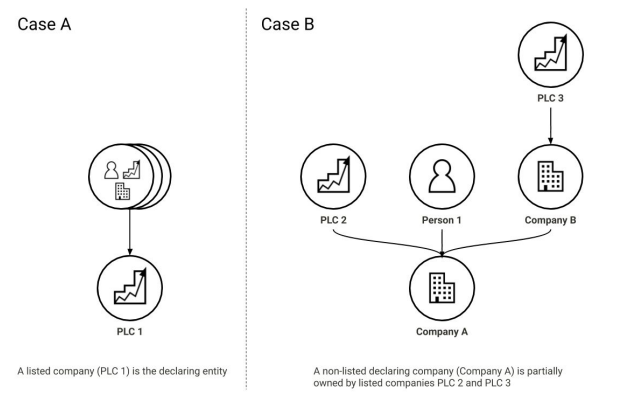

Case B: Collecting information about listed up-chain companies

If a declaring entity is required to disclose its beneficial owners and a listed company has a significant* direct (or indirect) interest in it, details of that “up-chain” listed company should be collected. The information about each up-chain listed company that should be submitted by the declaring company is set out in Appendix I.

In addition to the core information collected about the up-chain listed company and its listings, the following should also be required:

- the nature of ownership or control interests in the declaring company and their extent, including whether the interest is held directly or indirectly;

- in the case of an indirect interest held by an up-chain company, details of the chain of ownership should be described in line with guidance for declarations by non-listed companies.

Taking the Case B diagram as an example:

- Company A would need to disclose Person 1 as a beneficial owner if they met the relevant criteria;

- Company A would need to provide information about PLC 2 and the significant direct interest held by PLC 2;

- Company A would need to provide information about PLC 3 and the significant indirect interest held by PLC 3;

- the chain of ownership between Company A and PLC 3 would be described as required by existing guidance (for example, requiring the identity of Company B as the legal owner of Company A via which PLC 3 exercises its interests);

- Company A would itself need to look at the exchange filings of PLC 2 and PLC 3 to satisfy itself that there are no further beneficial owners exercising their interests via these listed companies.

* As a minimum, “significant” should be interpreted to mean: a direct or indirect ownership or control interest whose size, were it held by an individual person, would make that person a beneficial owner.

Implementers may consider a risk-based approach to setting disclosure thresholds. Where the nature of a sector or economy makes it vulnerable to corruption or other undesirable behaviours, setting lower thresholds to trigger disclosure requirements would be appropriate.

Next page: Appendix I: Core information about a listed company