Designing sanctions and their enforcement for beneficial ownership disclosure

Aims of sanctions

Centralised BO disclosure regimes include legal requirements for companies to disclose their beneficial owners to a mandated government authority. These requirements specify who qualifies as a beneficial owner; [7] which legal entities and natural persons are subject to disclosure; [8] what information they should disclose; [9] and when this information should be disclosed. Laws will also specify who is responsible and allowed to disclose the information. Whilst the responsibility is placed on the legal entity itself, in some countries only designated third parties (e.g. notaries or lawyers) are allowed to disclose information.

Legal requirements should specify which events trigger the requirement for disclosure and the timeframe within which the information must be submitted. Short time periods should be legally prescribed.[10] Disclosure should follow:

- initial incorporation of the legal entity;

- all subsequent changes in BO: it is important to require the disclosure of all changes as this otherwise presents a substantial loophole (see Figure 2);

- a set period of time: periodic confirmation that the disclosed information is still correct, at least on an annual basis.

The aim of BO sanctions regimes is to drive up compliance to legal requirements and to increase the quality of BO data in order to ensure that the data on the register is “adequate, accurate, and up to date”, thereby complementing verification mechanisms.[11] Therefore, an important consideration for policy makers and implementers is to determine the conduct that should be subject to sanctions to ensure the effectiveness of the BOT regime. This section highlights and discusses various potential sanctionable offences that should be included within the BOT regime of a country. It also briefly highlights some of the recent developments and concerns raised on the appropriate use of BO data by users, and discusses the potential sanctionable offences in this regard.

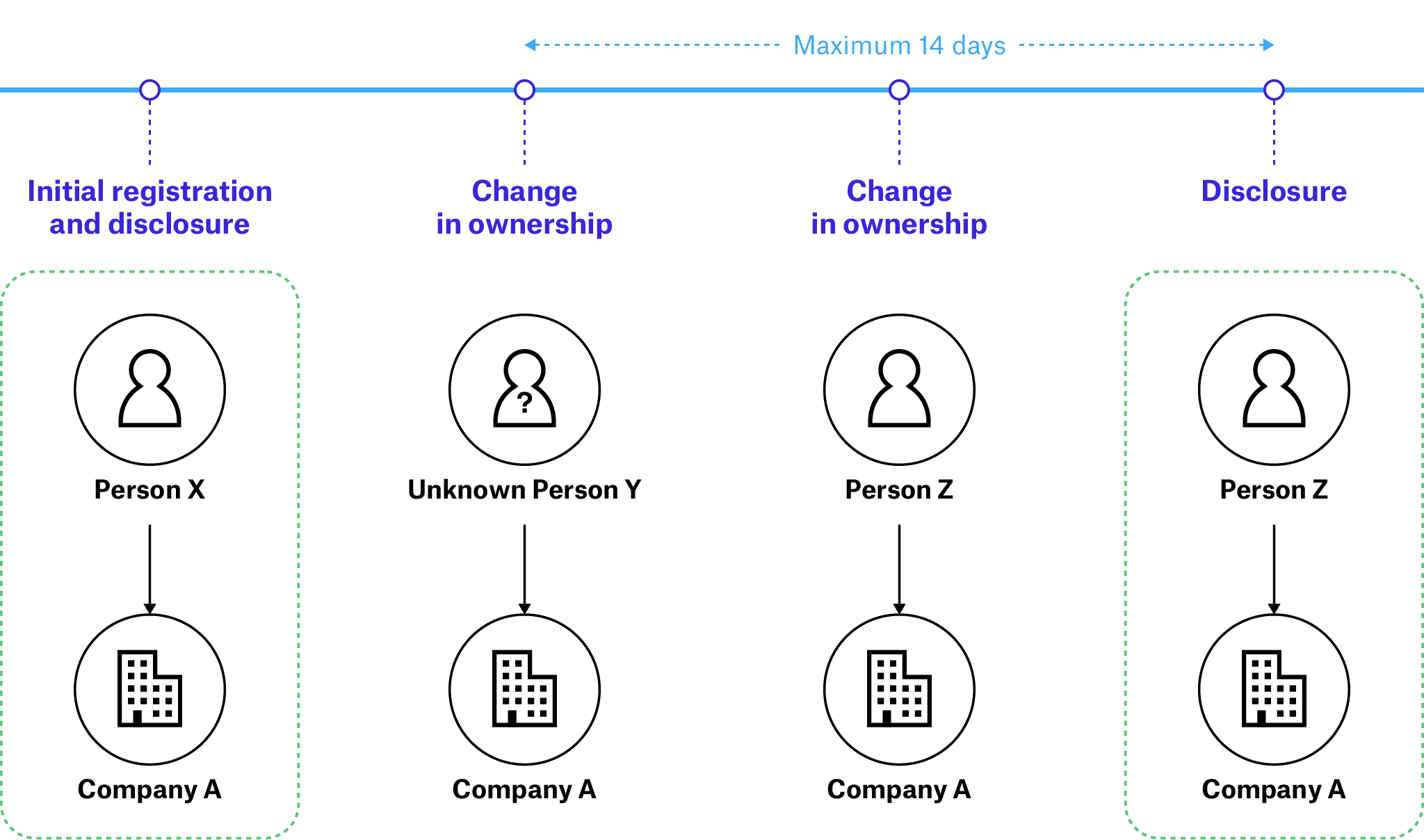

Figure 2. Reporting requirements loophole for changes in beneficial ownership

In this example, Company A has disclosed Person X to be its beneficial owner at initial registration. Later, Person Y replaces Person X as the company’s beneficial owner. The prescribed time period for reporting changes in this jurisdiction is 14 days. Within this time period, the beneficial owner of Company A changes again, from Person Y to Person Z. If there is no requirement to report all changes in BO, Person Y can legally avoid disclosure – and potentially exploit this for illicit purposes – provided that Person Z is disclosed as the beneficial owner within the prescribed time period of the first change in ownership.

End notes

[7] Please see “Open Ownership Principles – Robust definition”, Open Ownership, updated July 2021, https://www.openownership.org/en/principles/robust-definition/.

[8] Please see “Open Ownership Principles – Comprehensive coverage”, Open Ownership, updated July 2021, https://www.openownership.org/en/principles/comprehensive-coverage/.

[9] Please see “Open Ownership Principles – Sufficient detail”, Open Ownership, updated July 2021, https://www.openownership.org/en/principles/sufficient-detail/.

[10] Please see “Open Ownership Principles – Up to date and auditable”, Open Ownership, updated July 2021, https://www.openownership.org/en/principles/up-to-date-and-auditable/.

[11] Please see “Open Ownership Principles – Verification”, Open Ownership, updated July 2021, https://www.openownership.org/en/principles/verification/.

Next page: Sanctionable offences in beneficial ownership transparency regimes