Guide to drafting effective legislation for beneficial ownership transparency

Introduction

Beneficial ownership transparency (BOT) of corporate vehicles through central beneficial ownership (BO) registers has gained momentum around the world as a policy solution to a number of challenges. Through implementing BOT, governments seek to improve public procurement and spending; foster accountability and trust in society and the economy; and combat corruption, money laundering, and related criminal activities. Irrespective of the objective, the collection, storage, and sharing of beneficial ownership information (BOI) must be anchored in legislation. Legislation is a foundational element in the implementation journey towards creating effective systems for collecting high-quality data in central BO registers as well as ensuring compliance, as it provides the legal basis for their establishment and operation.

Creating an effective, central BO register is core to BOT reforms. Effectively centralising BO data in one or more registers means that people and authorities can access authoritative information on the beneficial ownership of legal entities and legal arrangements – collectively referred to as corporate vehicles – rapidly and in a standardised format. To achieve this, new or amended legislation should define the parameters of BO disclosure. This includes, among others, defining who a beneficial owner is; what information should be collected on beneficial owners and entered into a register; what information should be shared and with whom; and which corporate vehicles will be subject to disclosure.

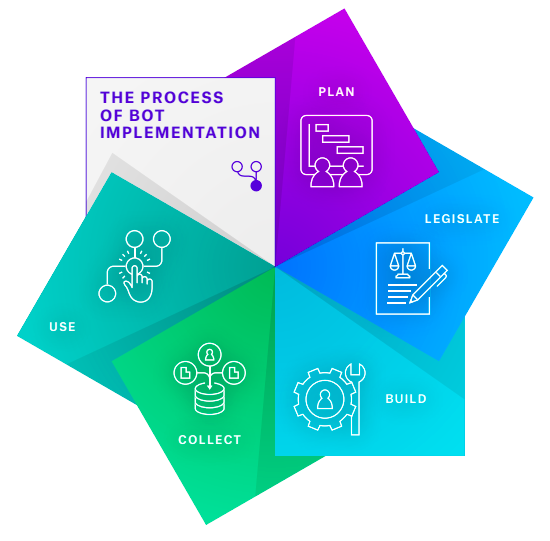

A country’s legislative framework must be clear, comprehensive, and practical to implement. Developing such a framework requires careful consideration, especially given that BOT as a policy area is relatively nascent and still evolving. In the journey of implementation (see Figure 1), the legislation stage is crucial, as it underpins the other stages of implementation and can enable or hamper the efficacy of the reforms. This guide aims to provide practical advice on what it means to effectively legislate for the implementation of BOT.

Figure 1. The process of beneficial ownership transparency implementation

A country implementing BOT should start with developing a clear plan for the reforms. Countries then establish an enabling legislative framework. In most countries, digital systems are built to collect, store, and share BO data with relevant actors for use. For more information, see Open Ownership’s Guide to implementing beneficial ownership transparency. [2]

Purpose of this guide

There is a growing number of guides, toolkits, and manuals for aspects relating to implementing BOT. [3] Whilst all these resources have their specific merits, few have focused specifically on the legislative process and specific approaches taken by other countries, which is often requested by implementing agencies. This guide is intended to assist individuals involved in drafting and reviewing laws to develop a clear picture of the elements that constitute effective legislation for implementing BOT reforms, laying the groundwork for establishing a BO register. The term legislation encompasses the entire collection of laws, which includes both primary and secondary (or subsidiary or delegated) legislation, as well as the rules, codes, policies, and directives that originate from the legislature, the executive branch, or any other regulatory or law-making body. This guide is not meant to be used as a model law, but offers a set of principles, practical examples, and considerations for designing legislation.

In implementing BO reforms, legislators may amend existing legislation to include provisions for BOT or establish new legislation on beneficial ownership. For implementing agencies and legal drafters who will be leading or participating in any of these processes, this guide will cover the elements that comprise effective legislation, including examples to illustrate emerging good practice as well as common pitfalls. This guide can also be used to equip parliamentarians who may be scrutinising the passage of a BOT bill. It may also be relevant for those with obligations under the legislation. Creating an enabling framework for the effective collection, storage, and sharing of BOI may involve new and technical concepts.

The guide focuses on the technical characteristics of an effective legislative framework for beneficial ownership rather than the external political, social, economic, and cultural factors that are known to influence implementation. Due to the differences in legal systems and contexts, there is no single best way to develop applicable legislation. Consequently, this guidance provides an overview of the core components one would expect to see in effective legislation, illustrating the importance of each component with country examples. This is not an exhaustive guide to legislating for BOT, and various elements still need to be adapted to local contexts. The guide is informed by Open Ownership’s policy framework for effective disclosure (see below); international standards set by the Financial Action Task Force (FATF) [4] and the United Nations Convention Against Corruption (UNCAC); and extensive in-country experience supporting implementing agencies in different contexts around the world. [5]

Box 1. Open Ownership Principles for effective beneficial ownership disclosure [6]

The Open Ownership Principles (OO Principles) are a framework for considering the elements that influence whether the implementation of reforms to improve the BOT of corporate vehicles will lead to effective BO disclosure – that is, it generates high-quality and reliable data, maximising usability.

These principles are intended to support governments implementing effective BOT reforms and guide international institutions, civil society, and private sector actors in understanding and supporting reforms. They provide a tool to identify and separate issues affecting implementation, and provide a framework for assessing and improving existing disclosure regimes. If implemented together, the OO Principles enable disclosure systems to generate actionable and usable data across the widest range of policy applications of beneficial ownership.

The OO Principles consist of the following:

- BO should be clearly and robustly defined in law, with sufficiently low thresholds set to ensure all relevant ownership and control interests are disclosed.

- Disclosure requirements should comprehensively cover all relevant types of entities and arrangements.

- BO declarations should collect sufficient detail to allow users to understand and use the data.

- Data should be collated in a central register.

- Sufficient information should be accessible to all relevant data users without undue restrictions.

- BOI should be collected, stored, and shared as structured and interoperable data.

- Measures should be taken to verify the data.

- Data should be kept up to date and historical records maintained.

- Effective, proportionate, and dissuasive sanctions for noncompliance should exist and be enforced.

Different aspects of this policy framework are covered in primary and secondary legislation to varying extents.

How this guide is structured

This guide covers the various approaches to legislative reform as well as the different types of legislation that should be considered, including whether provisions should be a part of primary or secondary legislation.

It subsequently provides an overview of the various components of effective legislation, grouped together based on where they may commonly be found. For each component, it will contain the following:

- an introduction to what the component is and why it is important;

- country examples showing how the component has been accommodated in law; [7]

- an example of where in legislation the component may be best accommodated.

Endnotes

[2] Open Ownership, Guide to implementing beneficial ownership transparency (s.l.: Open Ownership, 2021) https://www.openownership.org/en/publications/guide-to-implementing-beneficial-ownership-transparency/.

[3] See, for example: Open Ownership, Guide to implementing beneficial ownership transparency; FATF, Guidance on Beneficial Ownership of Legal Persons (Paris: FATF, 2023), https://www.fatf-gafi.org/content/dam/fatf-gafi/guidance/Guidance-Beneficial-Ownership-Legal-Persons.pdf.coredownload.pdf; FATF, Guidance on Beneficial Ownership and Transparency of Legal Arrangements (Paris: FATF, 2024), https://www.fatf-gafi.org/content/dam/fatf-gafi/recommendations/Guidance-Beneficial-Ownership-Transparency-Legal-Arrangements.pdf.coredownload.inline.pdf; Organisation for Economic Co-operation and Development (OECD) and Inter-American Development Bank (IDB), Building Effective Beneficial Ownership Frameworks: A joint Global Forum and IDB Toolkit (s.l.: OECD and IDB, 2021), https://web-archive.oecd.org/tax/transparency/documents/effective-beneficial-ownership-frameworks-toolkit_en.pdf; International Monetary Fund (IMF), Unmasking Control: A Guide to Beneficial Ownership Transparency (Washington, DC: IMF, 2022), https://www.imf.org/en/Publications/Books/Issues/2022/10/06/Unmasking-Control-A-Guide-to-Beneficial-Ownership-Transparency-517096; Alexandre Taymans and Julian Hicks, Building a Country Roadmap for Beneficial Ownership Disclosure Regime: The EU Global Facility’s Approach (s.l.: EU AML/CFT Global Facility, 2024), https://www.global-amlcft.eu/wp-content/uploads/2024/05/BO-Country-Roadmap-vfinale.pdf; and Andres Knobel, “Roadmap to Effective Beneficial Ownership Transparency (REBOT)”, Tax Justice Network (TJN), 7 February 2023, https://taxjustice.net/2023/02/07/roadmap-to-effective-beneficial-ownership-transparency-rebot/.

[4] The FATF’s Recommendation 24 requires a multi-pronged approach, including: countries requiring legal entities to obtain and hold adequate, accurate, and up-to-date information on the entity’s own beneficial ownership; information held by a public body or authority in a registry, or an alternative mechanism; and supplementary measures, such as information held by stock exchanges and financial institutions. This guidance covers aspects of the first two prongs. These approaches are also relevant to meeting requirements under Recommendation 25 regarding legal arrangements. It does not cover activities which the FATF may require in advance of a legislative process, such as conducting national risk assessments. See: FATF, The FATF Recommendations: International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation (Paris: FATF, updated 2023), https://www.fatf-gafi.org/content/dam/fatf-gafi/recommendations/FATF%20Recommendations%202012.pdf.coredownload.inline.pdf.

[5] “Open Ownership map: Worldwide action on beneficial ownership transparency”, Open Ownership, n.d., https://www.openownership.org/en/map/.

[6] Open Ownership, Open Ownership Principles for effective beneficial ownership disclosure (s.l.: Open Ownership, updated 2023), https://www.openownership.org/en/principles/.

[7] Where legislation has not been published in English, the quoted text has been provided using Google Translate. Occasionally, the translated text has been edited for clarity.