Lessons for an accountable transition: Leveraging beneficial ownership information for natural resource governance

Supporting integrity and accountability throughout the value chain

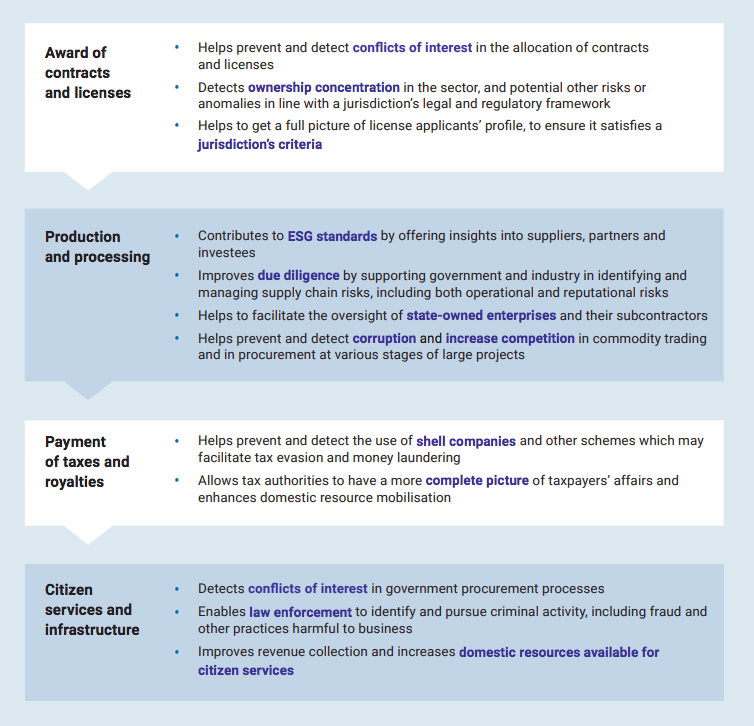

Industry and government stakeholders have a series of stages to consider when setting up or approving projects that can ensure responsible natural resource use and governance. While information on beneficial ownership may not be as extensively used at every stage of the extractives value chain, it has cross-cutting relevance throughout (Figure 1). [11]

One of the biggest integrity risks throughout the extractive sector value chain is corruption. [12] Corruption can take many forms, such as grand corruption, the bribery of public officials, the misappropriation of public funds or conflicts of interest in granting public contracts, but in all forms, it includes the abuse of entrusted power for private gain. [13] Other major risks that are particularly heightened at specific stages of the value chain include a range of illicit practices in extractive operations and revenue collection. Civil society actors have been playing an oversight role to call attention to these practices and raise the importance of BOT in supporting accountability in the industry.

Box 1. Civil society calls for comprehensive beneficial ownership disclosure

In Argentina, civil society has highlighted that the lack of accessible information about ownership of the mining sector at the national level makes it hard to build an accurate picture of governance and ensure its public oversight. Yet in 2023, with support from the Opening Extractives programme, the journalist network Red Ruido and civil society organisation (CSO) Fundeps attempted to investigate the provincial governance of lithium exploitation in two northern provinces of Argentina. As beneficial ownership information was not available in the region, they used accessible information on legal ownership as well as contracts, royalties and many other indicators to investigate. They found that four of the world’s largest investment funds and financial companies, which all hold shares in each other’s capital investments, were also the main direct or indirect shareholders of the lithium companies operating in the two provinces. By looking into the companies’ annual accounts and reports, they managed to find names of actual people holding shares and receiving dividends. However, the additional amount of shares collectively held by all these natural persons still only accounted for about 1% of the total shareholding, a very small part of the picture.

The investigation showed the complexity of ownership networks involved in the exploitation of lithium in the country and highlighted how difficult it is to identify the ultimate beneficial owners of these high-value mining projects. The heavy use of investment funds added further complications, as they are exempt from beneficial ownership disclosure requirements in many jurisdictions. [14] The lead researchers called for access to better-quality information to ensure public oversight and help detect any potential signs of corruption and fraud in the context of the race towards transition minerals. [15] Beyond the disclosure of beneficial ownership information for investment funds, this case also highlighted the need for improving information on existing regulations and practices relating to complex corporate structures and beneficial ownership. This information is essential to equip civil society to its public oversight function.

This section provides an overview of main integrity risks throughout the value chain and how a variety of actors, including government agencies, the private sector and civil society, can use information on beneficial ownership to support accountable governance. It starts with a detailed look at the use of beneficial ownership data as part of licensing and contracting, a key point at which such data can improve accountability in natural resource governance. Developing BOT reforms and other policies that help promote public integrity can have an important impact on governments’ capacity to generate domestic resources that can be mobilised to create social and economic benefits for citizens, including through the delivery of quality public services.

Licensing and contracting: A key point for data-driven decision-making

Governments of resource-rich countries are responsible for granting licenses, contracts, concessions and other agreements (hereafter, “licenses and contracts”) for the exploration and exploitation of oil, gas and minerals. A single jurisdiction may have several types of licenses and contracts for oil, gas and mining that it grants to companies. These typically include fiscal terms and social and environmental commitments, including provisions for local content, duration and terms for decommissioning. While this briefing focuses on oil, gas and mineral resources, it should be noted that jurisdictions may adopt similar licensing processes for a range of sectors whose governance has relevance to the energy transition and natural resource management more broadly. Examples include forestry and fisheries as well as renewables infrastructure, such as the construction of wind farms. [16]

The granting of a license or contract to a company may follow one of several processes, including bidding rounds, auctions, direct negotiations and awards on a first-come-first-serve basis. Some processes have clear requirements, such as spelling out how companies can qualify to apply and what qualifies as a transfer of a license or contract that has previously been awarded. While each context and process is unique, all involve decisions that can tip the balance between successfully safeguarding the public interest in the use of natural resources and their governance being compromised through conflicts of interest and other integrity risks. This stage of the value chain also offers an opportunity to advance additional policy objectives, such as greater domestic ownership of and benefit from the sector, as recognised by international standards.

Decisions made during the licensing and contracting phase can tip the balance between safeguarding the public interest in the use of natural resources and their governance being compromised through conflicts of interest and other integrity risks.

Box 2. EITI strengthens recommendations on the use of beneficial ownership information as part of licensing processes

The 2023 EITI Standard has reinforced the connection between licensing and beneficial ownership information, helping ensure that licenses are granted to transparent and accountable entities. Requirements 2.2 on Contract and license allocations and Requirement 2.3 on Registers of licenses state:

- Requirement 2.2: Where licenses are awarded through a bidding process, the government is required to disclose the list of applicants, including their beneficial owners in accordance with Requirement 2.5, and the bid criteria.

- Requirement 2.3: Implementing countries are encouraged to link publicly available license registers to government platforms that disclose or hold information in accordance with Requirement 2.5 on the legal and beneficial owners of oil, gas and mining companies.

Detecting the main risks during the licensing and contracting stage

Accountable decision-making as well as open and competitive bidding processes to allocate and transfer extractive licenses and contracts are needed to ensure that only competent, efficient and responsible parties are permitted to be involved in the exploration and extraction of natural resources. [17] Lack of solid accountability mechanisms at this stage has facilitated many cases of corruption and fraud.

Box 3. Mining magnate and associates convicted based on alleged “corruption pact” for iron exploitation

In 2021, a billionaire businessman appeared before a criminal court in Switzerland for alleged corruption of foreign public officials, including bribing a wife of Guinea’s former President to benefit from one of the biggest iron ore deposits in the world. [18]

A 2013 article in The New Yorker reported that in the early 2000s, with no prior experience in trading iron ore, the magnate’s company was granted an exploration permit previously held by Rio Tinto. [19] Subsequently, investigations alleged that the businessman had paid substantial bribes to public officials in Guinea in return for ensuring his company would be granted mining rights for a large iron ore deposit in the country.

Among the many sophisticated approaches used in this bribery scheme, prosecutors said the businessman and associate intermediaries, such as legal and financial experts, used opaque corporate structures and networks of bank accounts spreading across multiple jurisdictions, including the Bahamas, Israel, Switzerland and the United States (US) to facilitate illicit financial flows (IFFs). [20]

Despite an appeal, the Court upheld his conviction to three years in prison (of which 18 months were suspended) and approximately USD 55 million compensation claim. [21] This example is not isolated, and the opacity of international financial systems remains an obstacle that makes investigators’ jobs harder, as demonstrated by more recent cases such as the Luanda Leaks. [22] Illustrated by local civil society’s reaction to the conviction, this case highlights the need for concerted efforts to increase transparency, including on the beneficial ownership of corporate vehicles. [23]

Agencies in charge of licensing and contracting processes can use beneficial ownership information as part of their due diligence to detect any potential indication of conflicts of interest, fraud and other anomalies, and to help ensure compliance with relevant regulatory requirements. BOT is also important when enforcing local content provisions to ensure national preference criteria are respected and to guard against specific conflicts of interest, such as when local officials and companies or their representatives monopolise the provision of services to extractive projects through companies that they own. [24]

Examples of major risks that can be detected at this stage of the value chain include:

- Ownership concentration, where individuals conceal their ownership of several companies; for example, because they are engaged in speculation, competing for the same bid or colluding to inflate prices or distort the market or selection process. [25]

- Conflicts of interest, where there is undue political influence; for example, on decisions to award, transfer, renew or suspend licenses and contracts.

- Deliberate avoidance of criteria, where individuals hide behind opaque corporate networks to obtain licenses or contracts for which, according to laws and regulations, they do not legally qualify; for example, because they are sanctioned or do not meet nationality or other requirements.

Using beneficial ownership information to identify and address risks

To help detect and mitigate major integrity risks, the procedures and criteria on which the decisions to award, transfer, renew or suspend licenses and contracts should be made public, along with complete information on the beneficial owners of any bidding companies. [26] Other measures, such as asset disclosures for politically exposed persons (PEPs) and campaign finance transparency, complement BOT in preventing these processes from being compromised by corruption.

Actors such as law enforcement, regulatory authorities, procurement authorities, CSOs and investigative journalists are increasingly using ownership data and other types of information, and growing evidence has emerged on how to support their effective detection of risks, including at the licensing and contracting stage. [27] For instance, expert organisations have documented how risks have manifested in various corruption cases across the world and how beneficial ownership information can help to detect and mitigate these risks.

Box 4. Red flags for corruption risks in the award of licenses and contracts

Research on governance-risk patterns in the extractive sector highlights how the availability of beneficial ownership information can help address them. The Natural Resources Governance Institute (NRGI) identified 12 red flags that can indicate corruption risks in the award of extractive sector licenses and contracts. These are based on over 100 real-world cases of license or contract awards in the oil, gas and mining sectors in which accusations of corruption arose. Over half of these cases involved companies with hidden beneficial owners. They illustrate how beneficial ownership information can be used to help identify a range of specific warning signs, such as when:

- Companies submit incomplete or false materials as part of the selection process – for example, during the pre-qualification or due diligence phases. This can be a sign of an unqualified company competing for an award.

- Officials involved in selecting the winner or their close associates are directors, officers or owners of a company that is competing for the award or consult for, provide services to or otherwise do business with a company that is competing for the award. This can be a sign that an official with influence over the selection process has a conflict of interest.

- The shareholder structures of companies include names that appear to be altered or fabricated. This could be the name of a person or company for which no public records exist; a name that appears to have been deliberately misspelled; a name that no one with relevant knowledge recognises; a name that otherwise closely resembles some other, identifiable name; or a known or suspected alias. This can be a sign of a hidden PEP. [28]

In their corruption diagnostic tool, NRGI also explains how collection, disclosure and vetting measures can further support this risk detection and mitigation work. For example, they highlight that effective policies should include measures to verify information on ownership and control for all shareholders who exceed a set threshold or who are considered high risks. It also highlights the importance of requiring major subcontractors and commodity traders to disclose their beneficial owners. [29]

Examples of relevant questions that beneficial ownership information can help answer

Identifying the types of questions that can be asked and answered with information on beneficial ownership can help shed light on the range of ways in which beneficial ownership data can be used in licensing and contracting processes. There are some common questions that licensing agencies can use to help identify a variety of risk types, and which can, for example, support identification of potential conflicts of interest, tax evasion or collusion.

Are there any signs of the company being a shell company or using nominees?

Shell companies that have little or no direct business activity can have legitimate uses. However, a license applicant that is a shell company, or has one in its ownership structure, should be interpreted as a potential red flag for further investigation in licensing processes. Similarly, individuals who do not wish to appear in a register of beneficial ownership information may intentionally hide their status as a beneficial owner through an undisclosed or illegitimate nominee arrangement. Such arrangements involve the appointment of directors or shareholders otherwise unconnected to the company to carry out the functions of a beneficial owner on their behalf.

For example, in Canada, before the recent launch of the federal register, those looking for anonymity were able to hire a nominee for as little as a few dollars a day. Some corporate service providers set up thousands of shell companies each year using professional nominees who held hundreds or even thousands of appointments. [30] Company declarations that include full ownership chains are more likely to reveal potentially problematic legal constructions such as shell companies or nominees.

Screening for shell companies and nominees is among the most challenging uses of beneficial ownership data, but looking at patterns in datasets at the point of evaluating an application can serve as a means of picking up warning signs. Examples include: a beneficial owner of an applicant company being a shareholder or director in many other corporate vehicles; a large number of companies being registered at the same address or sharing the same phone number as the applicant; and frequent or recent changes in beneficial ownership or company information (e.g. name, address) by the applicant.

Characteristics of individuals or companies appearing in disclosures can also raise red flags. Examples include having an ownership structure with five or more observable layers; [31] residency or registration in a jurisdiction with a high level of financial secrecy or economic or political sanctions; [32] the company being recently incorporated or having very young or old beneficial owners; [33] and a beneficial owner working for or with a law firm, corporate services firm or other business that specialises in creating shell companies or managing private wealth.

The salience of these risk factors may furthermore vary by context and license type. For example, research looking at data from over a hundred countries over more than twenty years has shown that the increased incorporation of offshore entities in tax havens is more strongly associated with the awarding of exploration than production of licenses, and the relationship is strongest in countries where oil revenues play a central role in the economy. [34]

Agencies can use beneficial ownership information to detect conflicts of interest, fraud and other anomalies, and to help ensure compliance with regulatory requirements.

Is there any sign that a PEP is influencing the company or would benefit from its activities?

Seeking to answer questions about the use of shell companies and nominees may lead to detecting risks of potential conflicts of interests with concealed influence from or benefits to political figures or their relatives. Agencies accessing beneficial ownership information as bulk data rather than individual declarations can more easily interlink it with other datasets to detect problematic relationships or associations. Tools to connect and visualise data from multiple sources allow for more sophisticated analyses and red-flag detection.

Examples of useful complementary datasets include contracting data, asset declarations and sanctions and lists of PEPs. Licensing authorities should also review other disclosures, such as those required by the EITI Standard on PEPs, [35] and assess whether the presence of a PEP in a company’s ownership structure presents an undue risk to the integrity of the licensing process. The EITI Standard requires EITI-implementing countries to request full disclosure of PEPs’ beneficial ownership in extractives companies, regardless of their level of ownership. Non-governmental initiatives have also been developing useful tools which have the potential to support licensing agencies with their screening.

Box 5. Joining the Dots with Politically Exposed Persons in Nigeria: A tool connecting beneficial ownership information with politically exposed persons and licensing data

The Opening Extractives programme supported several civil society initiatives to use beneficial ownership data as part of dedicated projects. [36] One of them was Joining the Dots with Politically Exposed Persons in Nigeria – an initiative led by Directorio Legislativo that compiles, verifies and cross-checks information on PEPs who are beneficial owners of companies holding mining, oil and gas licenses. Its objective is to foster transparency and fight corruption in the extractive sector. This builds on learning from the first Joining the Dots project in Colombia, which combined data on financial declarations of public officials; the list of extractive and hydrocarbon companies operating in the country; and public procurement data to identify potential conflicts of interest. [37]

The new tool developed in Nigeria allows any user to identify three types of risk alerts for potential conflicts of interest or irregularities:

- First, a PEP that is a beneficial owner of a mining, oil or gas company registered in the Nigerian state, looking at companies with active extractive licenses.

- Second, a PEP relative who is a beneficial owner of a mining, oil or gas company registered in the Nigerian state, looking at companies with active extractive licenses.

- Third, an irregularity in which a mining, oil or gas company has another company listed as a beneficial owner, instead of a natural person. [38]

When analysing the data, Directorio Legislativo uncovered over 500 potential red flags and also generated some key insights. For instance, most PEPs involved in potential conflicts of interest are or were part of the Legislative branch, with over 40% being members of the House of Representatives. While the full dataset included companies from oil and gas as well as mining, three quarters of companies flagged under the third type of risk alert were concentrated in the oil and gas industry. [39]

The launch of the platform has advanced transparency and accountability in Nigeria’s extractive sector by making data easier to use for public oversight. However, the project has also faced challenges related to data availability, structure and reliability.

For instance, a lack of reliable identifiers and other data has led Joining the Dots to include a disclaimer on the website acknowledging the limitations in determining whether a particular PEP is the beneficial owner in question. [40] Projects like Joining the Dots help point to concrete areas for improvement of data accessibility and usability, and raise governments’ attention to potential areas of investment to support progress in this area.

Stakeholders in Nigeria at the Joining the Dots launch. The platform has advanced transparency and accountability in Nigeria’s extractive sector by making data easier to use for public oversight

Does the applicant’s information, qualifications and profile satisfy a jurisdiction’s criteria?

Governments can define a range of technical, financial and other criteria to determine who qualifies to obtain extractive sector licenses or contracts. While the managers of a given company may meet these criteria, exploring who ultimately owns or controls this same company is useful to ensure that competent agencies have full visibility on a company’s profile. Examples of criteria to consider may include: criminal records of a company’s management and beneficial owners; a company’s history of compliance with tax and other legal requirements; and/or nationality requirements. Knowing an applicant’s beneficial owners can allow for criminal background checks and related due diligence to be performed. For example, Ghana’s Companies Act prohibits individuals with criminal convictions or a history or fraud from doing business in Ghana.

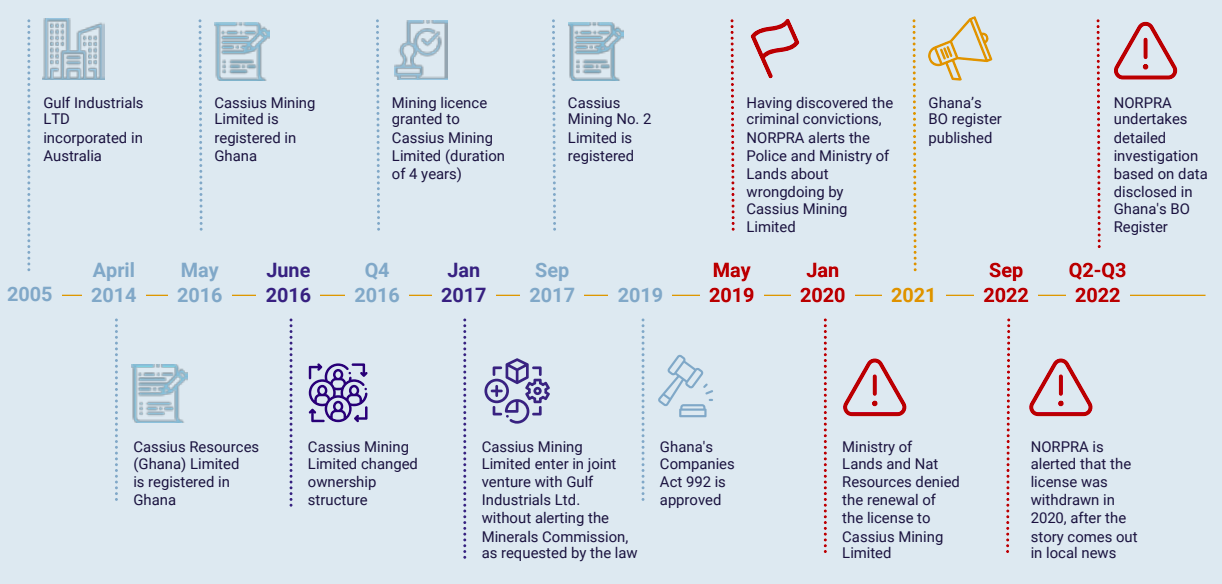

Box 6. Revoking rights to mine on the basis of criminal conviction in Ghana [41]

In 2020, Ghana’s Minister for Mines instructed the Minerals Commission not to renew a license for a company on the grounds of convictions of the directors by courts of competent jurisdiction in Australia. This decision was made public following investigations by the CSO Northern Patriots in Research and Advocacy (NORPRA), who searched Ghana’s beneficial ownership registry after it was launched in 2020 to find out more information about the large-scale mining company, which had been granted a concession to mine gold in an area initially earmarked for small-scale mining activities. NORPRA found that each of the beneficial owners reported to the register had criminal convictions, including on crimes of narcotic drugs, fraud, market manipulation, unprofessional conduct and breach of duty.

A timeline of NORPRA’s investigations and findings

Note: This graphic has been compiled from information reported by NORPRA on a best efforts basis.

In jurisdictions that set criteria on a maximum number of licenses a company can hold, an agency may want to develop a complete database of current and historical information on the beneficial ownership of all active and inactive licenses in order to check the number of licenses an applicant company or its beneficial owner holds or has held through other corporate vehicles. For example, Zambia has proposed limiting the number of licenses held by one company to five in order to help curb speculative purchases within the country’s licensing system. [42] According to the Minister of Mines and Minerals Development, there may be considerable challenges in enforcing this without information on beneficial ownership: “[...] some companies own too many mining rights, using either a single or multiple companies with the same beneficial owners”. [43]

Where the beneficial owner or applicant company is from another jurisdiction, their qualifications and track record may be more challenging to verify. If an agency is collecting disclosures itself or is relying on a domestic register, one option is to cross-check this information against beneficial ownership or company registers in the applicant or beneficial owner’s home jurisdiction to help verify the information provided. Conducting media-monitoring checks using international data sources on court cases, sanctions lists as well as platforms such as the Organised Crime and Corruption Reporting Project’s Aleph is also useful. [44]

Additional considerations for licensing and contracting integrity

In addition to the award of licenses, it is also important to consider similar risks as part of the transfer of contracts and licenses. [45] In either case, procedures should be clear and transparent, as ambiguity or vague language can create integrity risks. [46] Given many agencies face resourcing constraints, prioritisation in the use of data may be required.

Box 7. Risk assessment tools for license screening

The World Bank recommends a credible risk analysis of the extractive sector and of the risks presented by potential licensees as a starting point. Screening procedures can then be tailored in cost-efficient ways to mitigate the most serious risks, for example, by creating a risk matrix to help inform prioritisation in screening that includes relevant variables such as license type and whether the applicant’s beneficial owner(s) is a resident of the jurisdiction.

Transparency International offers comprehensive guidance on preparing such an assessment for anti-corruption, which involves: identifying the vulnerabilities to corruption in the awards process design, practice and context as well as the strengths that help to prevent and detect corruption; identifying, assessing and validating corruption risks; and prioritising risks. Such an approach can help inform when and how beneficial ownership data is used, given the resourcing limitations many agencies are likely to face.

Finally, ensuring stakeholders outside government can readily access beneficial ownership data in a format that is easy to use for their work is also essential to promote accountability within the extractive and energy sectors. Where beneficial ownership data is available for a broad range of actors, often including the public, CSOs and investigative journalists have used beneficial ownership information to raise red flags and hold both corporate and government actors accountable.

Box 8. Armenian journalists’ investigation into the completeness, quality and red flags in beneficial ownership information for extractives [47]

Armenian law requires mining companies that have a license to extract metallic minerals to make beneficial ownership declarations. However, Armenian journalists discovered that 5 of the 22 companies with mining permits may have submitted incorrect or incomplete declarations, or did not submit them at all. For example, a mining company submitted declarations in 2020 and 2022. While the declaration in 2022 added an additional beneficial owner to the three individuals listed in the 2020 declaration, it lacked required information on indirect ownership and on the level of participation for two of them. Indirect ownership information from 2020 mentioned companies incorporated in jurisdictions with high levels of financial secrecy. However, the declaration in 2022 did not include anything on intermediary companies in the ownership chain.

This type of investigation is important for holding companies as well as governments to account for implementing their licensing policies and procedures. In this case, the State Register of Legal Entities of the Ministry of Justice defended the mining companies, saying the companies are aware of their duties and fulfill them, and noted that the State Registrar accepts the information submitted by companies as true unless a complaint is registered.

Stakeholders from Armenia participate in a workshop on strengthening beneficial ownership data use and enabling civil society to use beneficial ownership data to improve governance of natural resources

Supporting oversight of extractives operations: Beneficial ownership data for accountable businesses

Beyond the licensing and contracting stage of the extractive value chain, government agencies, companies and other non-governmental actors can use beneficial ownership data to support oversight of extractive operations. This may include ensuring integrity of business relationships; preventing and detecting illicit activities; and supporting accountability for corporate social responsibility and environmental, social and governance (ESG) commitments in the context of the energy transition to address climate change.

Supporting healthy business practices with thorough supplier due diligence

To comply with domestic laws and prevent possible association with corrupt actors and criminals, businesses need to carry out thorough due diligence on suppliers, subcontractors, partners and investors. BOT reform can provide valuable information to help businesses navigate complex corporate structures: it enables them to have full visibility over who is behind the companies with which they do business. Moreover, it equips law enforcement agencies with crucial information to identify and prosecute fraudulent companies that cause harm to legitimate businesses and undermine fair market competition. [48]

Box 9. Using beneficial ownership information to support the integrity of subcontractors and supply chains

A number of international actors have developed standards, guidelines and reporting frameworks to support transparency and promote good practices in supply chain integrity in the extractive sector. [49] These spread across areas including disclosing information on the identity of suppliers and their taxation, spending and involvement in procurement processes. Data on beneficial owners is a resource that helps businesses and governments form a complete picture of suppliers’ identities to inform decisions or detect potential risks, such as conflicts of interest.

For example, many countries across Africa, Europe and the Middle East, publish lists of contact points (or at least names of suppliers) in their extractive industries. As part of EITI reporting, the EITI chapter in Iraq requested beneficial ownership information from the companies’ registrar to cross-check it against company and contract information disclosed by an oil and gas supplier involved in a large contract. EITI Iraq then identified the involvement of a foreign service provider that had not officially registered in the country, thereby breaching Iraq’s Foreign Company Branches Law. In this case, data on beneficial owners provided an additional layer of understanding in the corporate ownership structure, which was then relayed to the Ministry of Oil for further investigation of the supplier in question. [50]

Tackling illicit activities and holding the right actors to account for their impact

Many oil, gas, mining and energy projects have been run by companies with the necessary technical and financial capacity to support their work. However, individuals also use companies to make the most of loopholes and bypass laws to take advantage of this lucrative industry. Even where solid legal frameworks are in place, weak enforcement can leave room for the illegal exploitation of natural resources. Illegal extraction and cases of ill-qualified companies being granted licenses with substantial economic benefits for their beneficial owners – sometimes corrupt public officials – happen to the detriment of legitimate businesses and citizens. [51]

The illegal exploitation of natural resources also creates direct risks and harms to people and their environment, and these risks only increase when large projects take place in remote areas or locations populated by indigenous communities. [52] The extractive sector has seen links between illegal extraction of natural resources, environmental crime and human trafficking being reported across all continents. Environmental crime is reported as the third most lucrative of organised crime groups operating at the transnational level, generating up to USD 280 billion a year, with dire impacts on animals, people and their natural and economic environment. [53]

These illicit activities are usually associated with money laundering and tax evasion, and they are often facilitated by corruption. [54] Yet mechanisms are often lacking to prevent these activities, hold responsible actors accountable and provide compensation for the harmful impact of their activities. When those who ultimately benefit from these activities are hidden behind corporate structures, or when information about them is poor quality or difficult to access, it is harder for citizens and law enforcement to ensure accountability.

Companies have an interest in disclosing their own beneficial owners to proactively demonstrate transparent and responsible operations and attract investment.

Box 10. Addressing environmental and human rights risks through improved transparency and corporate accountability measures

In 2022, a team of journalists investigated two municipalities in Ghana with active limestone mining operations by both licensed and unlicensed companies. Their investigation found very poor living conditions for the local communities in the mining area: air pollution from dynamite used to blast limestone; local clinics’ health records showing high levels of acute respiratory infections; dust and noise from trucks transporting limestone on roads in deplorable conditions, including limestone dust spreading on food crops and burying the fertile topsoil, thereby causing drops in crop production. In addition, several companies were not paying the royalties and concession rents as required by the law, amounting to an estimated USD 80,000 gap in public funds.

Aiming to find the true owners of mining companies involved in this area, investigative journalists used Ghana’s beneficial ownership register to uncover that some PEPs and their family members were involved in the ownership of some of these companies. Despite a legal obligation to disclose this information, the majority of the operating mining companies had not declared their beneficial owners. This impeded the research team from fully assessing the ownership structure of the companies concerned, making it harder to hold them and their beneficial owners accountable. [55]

Beneficial ownership transparency as part of environmental, social and governance standards

Companies can also have an interest in disclosing their own beneficial owners to proactively demonstrate transparent and responsible operations and attract further investment. For example, in the context of the energy transition to address climate change, many investors have been encouraging corporate actors to do more on corporate social responsibility and ESG standards. [56] International actors are also increasingly monitoring and assessing progress in this regard. For example, the World Bank developed a new annual assessment of the world economies’ regulatory frameworks and public services, which includes environmental sustainability and gender considerations, as well as having an indicator on BOT. [57]

While EITI-supporting companies have demonstrated progress in this area, more opportunities exist to further improve corporate accountability. [58] Only a few of the leading standards for responsible business practices in the renewable energy sector directly or thoroughly address transparency, anti-corruption or governance issues. [59] Only one, the Green Hydrogen Standard, encourages beneficial ownership disclosure. [60] While ESG standards can be influential, national regulatory frameworks to mandate transparency and accountability are still key to supporting a thriving, healthy and transparent business environment over the longer term. This has benefits through to the very end of the value chain, including in creating public benefit through the provision of quality public services.

Box 11. EITI and over 60 supporting companies promote further investment in beneficial ownership transparency to advance accountability and good corporate governance

In 2021, EITI reinforced its framework to assess, monitor and learn from progress of companies that committed to the values embedded in the EITI Standard. At that time, Anglo American, BHP, Glencore, Newmont, Rio Tinto and Repsol all announced specific commitments on BOT. [61] In parallel, that same year over 60 of the biggest companies in the extractive sector globally were assessed on their adherence to the Expectations for EITI supporting companies, [62] a comprehensive package of measures that have been added to companies’ duties to promote integrity and accountability within the sector.

For example, companies are expected to engage in rigorous due diligence processes, including by using information on beneficial owners to assess risks and guide decisions in selecting joint venture partners, contractors and suppliers. [63] They are also expected to publish anti-corruption and gender diversity policies as well as publicly disclose a list of controlled subsidiaries, audited financial statements and project-level taxes and payments to governments.

EITI-supporting companies continue to be regularly assessed. The most recent assessment was carried out in 2023. [64]

In addition to tax obligations, extractive companies are often expected to make direct social and environmental contributions to the local areas where they operate. Whether it is driven by contractual obligations or done on a voluntary basis, these may include financial or material payments to local governments or social projects (e.g. building schools, bridges, etc.), which they may also subcontract to other companies to deliver. [65] Knowing who owns and controls companies that make payments and deliver social projects, including through subcontractors, is important for local communities and local officials to identify who should be accountable for quality delivery of these projects. Beneficial ownership information can also help inform who is responsible in case any irregularities occur, including in financial payments reaching the right beneficiaries.

Using beneficial ownership data to safeguard public financing

Revenues collected by governments from extractive companies represent a very important source of public funds, especially for countries with a high level of economic reliance on natural resources. Between 2000 and 2019, NRGI estimated the aggregated amount of traceable government revenue from natural resources at the global level to USD 14.7 trillion. [66] However, the stages of the value chain involving revenue collection and allocation – including those managed by state-owned enterprises (SOEs), such as national oil companies or sovereign wealth funds – have been prone to embezzlement and tax reduction, avoidance or evasion schemes that sometimes involve bribery of tax officials. [67]

Corruption, crime, fraud and tax crimes translate into capital flight and public revenue losses amounting to billions. For example, addressing IFFs and curbing capital flight could potentially allow African countries to recover an estimated USD 89 billion lost annually. [68] BOT can play a role in preventing and detecting risks in this area and in promoting accountability of relevant actors.

The world is losing USD 480 billion annually to tax abuse. Tax authorities can use beneficial ownership data to strengthen compliance.

Preventing and detecting tax avoidance and evasion

Tax avoidance and evasion are a significant piece of the global IFF landscape. According to the Tax Justice Network, the world is losing USD 480 billion annually to tax abuse. This includes USD 311 billion in cross-border corporate tax abuse. [69] Tax authorities can use beneficial ownership data to strengthen tax compliance by tracking changes in ownership; identifying and monitoring profiles of taxpayers with a history of tax evasion and foreign residents with tax liabilities; and identifying taxpayers who abuse corporate vehicles and tax treaties with opaque jurisdictions to conceal their identities and avoid taxation. Media and civil society have played a vital role in helping to bring suspicious cases to the attention of authorities.

Box 12. Tax authorities and civil society using beneficial ownership information to hold corporations accountable for tax liability

Tax agencies across regions have been highlighting the benefits of using beneficial ownership data in processes to ensure tax compliance. For example, a tax agency in an African country (jurisdiction A for the purposes of this report) used ownership data to help confirm double taxation agreement abuse. [70] The tax agency investigated a company after spotting changes in the company’s name and ownership structure. The relevant tax department used data from registers in two different jurisdictions to identify the tax residency of the company’s beneficial owners, whose identity was obscured by nominee shareholding agreements. Thanks to jurisdiction B, collecting information on nominees, the tax agency from jurisdiction A was able to prevent further tax evasion.

In Zambia, a CSO called the Centre for Trade Policy and Development (CTPD) recently carried out research on beneficial ownership, statutory compliance and tax compliance. Their focus was on several companies that were cited in the 2021 Auditor General’s report to have filed nil declarations for mineral royalty tax despite holding export permits and exporting various minerals, including copper, manganese and cobalt. The lack of declarations was found to account for mineral royalty losses to the government. According to the research team, beneficial ownership information for these companies was essential to hold their true owners to account for these losses. Facing challenges in accessing this information, they shared a number of recommendations with the government to improve compliance and ensure effective access to information in Zambia. [71]

Preventing and detecting risks of corruption in commodity trading

Commodity trading in the extractive industry includes trade in natural resources between states (or SOEs) and commodity trading companies, where such resources are typically resold to third party buyers. In many resource-rich countries, governments choose to receive the payments from companies for the right to extract resources “in-kind”, through physical transfers of oil, gas and minerals, rather than transfers of money in cash. In-kind revenues can also occur because the state or an SOE owns shares in a producing license. The state or SOE disposes of the resources received, often by selling them to commodity trading companies. Commodity traders may also provide resource-backed loans to governments or SOEs in exchange for future production of commodities. [72]

Commodity trading can be highly profitable and may involve companies that are privately owned and are therefore not subject to the same scrutiny from financial regulators as publicly listed companies.

There have been a number of high profile corruption cases in the commodity trading sector. IFFs linked to the export of extractive industry commodities in Africa alone were estimated to amount to USD 40 billion annually, [73] an amount that is roughly equivalent to the combined annual gross domestic products of Botswana and Guinea. [74] Moreover, as of 2021, 97% of independent (oil) trading companies’ subsidiaries were owned via holding companies based in offshore financial centres, compared to 18% among the top 100 global corporations outside of the sector. [75] Historically, some offshore centres have been associated with opacity and have been used for IFFs.

Despite the large revenues generated from commodity-trading activities, data on trading operations has been scarce and under-analysed, especially in producer countries. This raises risks that represent significant potential revenue losses, as almost half of government revenues reported through the EITI originate from the trading of oil, gas and minerals. [76] For this reason, commodity-trading transparency has become a priority to ensure the integrity of public revenue as reflected in EITI Requirements 3.3 on Export data and 4.2 on Sale of the state’s share of production or other revenues collected in kind. [77]

Complex transnational networks of corporate vehicles have been used by actors in the sector with the aim of preventing authorities from identifying their involvement in obscure deals. [78] In this context, data on beneficial ownership is an additional tool which can be used by authorities and a range of civil society actors to improve oversight and accountability in the area of commodity trading.

For example, in Nigeria, CSOs have used publicly available information on beneficial owners to support accountability in oil-for-swap deals. EITI Requirement 4.2 mentions the importance of disclosing such information for companies buying commodities. [79]

Box 13. A major oil company’s subcontractor asked to return funds defrauded from the government

In the early 2010s, Nigeria’s national oil company entered into various types of agreements to exchange crude oil for refined products to meet local demand. Shedding light on these oil-for-product swap deals, local non-governmental organisation (NGO) Policy Alert reported on losses of billions of dollars from these product swaps deals, representing loss of revenues that could have been used for social and economic infrastructure for the benefit of Nigerian citizens. [80] Policy Alert’s investigation shows the complexity of these deals, which included transactions between multiple corporate entities, including national oil companies, subsidiaries and private subcontractors trading crude oil for refined petroleum products.

In one of the several investigations carried out by the NGO, a beneficial owner of a subcontractor involved in these deals had also been implicated in major corruption cases involving an ex-minister of Petroleum. [81] The ex-minister and another managing director of an oil and gas company involved in the deals were convicted of subsidy fraud and sentenced to ten years in prison. The company was asked to refund approximately USD 564,000 defrauded from the Nigerian Government. The company was later declared bankrupt and could not pay off the outstanding liabilities it owed to the Federation Account Allocation Committee, the agency in charge of reviewing and allocating funds to the various States of Nigeria.

In press releases and public dialogues with government agencies, Policy Alert called for increased efforts from the Nigerian National Petroleum Corporation Limited and the Federal Inland Revenue Service to require information on beneficial ownership from companies bidding for their contracts, and to publish information to facilitate public oversights of contracts in the oil sector. They also encouraged the Corporate Affairs Commission, which manages Nigeria’s central register of beneficial owners, to consider “the importance of adopting a risk-based approach to the collection of beneficial ownership information submitted by extractive sector actors, by further verifying data submitted by extractive sector companies, including commodity traders”. [82]

Facilitating the oversight of state-owned enterprises and their subcontractors

In broad terms, SOEs are companies that are mostly owned or ultimately controlled by a government. They play a significant role in the extractive sector and can generate a large part of public revenue in resource-rich countries. [83] Given the direct link that SOEs establish between natural resources management and public revenue generation, transparency over SOEs’ ownership and management is central to well-functioning economies in resource-rich countries. SOEs also play a major role in commodity trading, as mentioned in the previous section of this briefing.

Bribery involving SOEs and commodity traders has been particularly common in resource-rich states with high levels of fragility and widespread corruption, where commodity traders can have very close interaction with government officials and gain opportunities to influence contracting and licensing award processes as well as payment of royalties or customs policies. [84] For this reason, several requirements of the EITI Standard focus on accountable governance of SOEs. This includes BOT, which is an important tool not only to enable transparent and accountable management of expenditures and general corporate governance, but also to support integrity in SOEs’ procurement and subcontracting. [85] The 2023 EITI Standard encourages SOEs to disclose the identity and beneficial ownership of their agents or intermediaries, suppliers or contractors for material transactions.

It is estimated that anywhere between 50-90% of the costs of a typical extractive industry project go to third-party suppliers of goods and services. [86] Procurement deals are brokered by SOEs as well as by large multinationals and other licensees. They are less visible and more numerous than the relatively higher-profile processes used to award exploration and production rights. Yet they often receive less attention in the literature compared to the processes involved in awarding exploration and production rights, making them harder to scrutinise. [87] Therefore, establishing regulations and processes to disclose information about suppliers and subcontractors is integral to responsible governance in supply chains. Law enforcement and regulatory agencies can also integrate beneficial ownership data as part of broader investigative and review processes to possibly sanction those benefiting from illicit activities of suppliers and subcontractors.

SOEs often have complex structures, with many subsidiaries and associates sometimes spreading across multiple jurisdictions. As they always involve government through either direct or indirect ownership stakes or controlling interests, understanding beneficial ownership of SOEs often falls outside of traditional definitions of beneficial ownership and requires specific guidance for governments implementing BOT reforms. It requires identifying the natural persons that exercise controlling interests on behalf of the state and enjoy benefits from their positions. [88] For example, controlling interests and benefits could include remuneration; preferred status; advantages within a specific market; and right to choose partners or conclude contracts. Existing evidence highlights that it is important to capture information about individual ministers and politicians rather than only listing their position. [89]

Organisations such as NRGI have produced guidance to support SOEs and their private-sector partners in preventing corruption. This includes recommendations to require third-party partners to disclose beneficial ownership information, at least starting with the biggest and highest-risk partners (e.g. joint venture partners, major suppliers above a certain threshold and commodity-trading intermediaries), and to consider not entering into a contract or terminating a relationship in case of noncompliance. The guidance reports how SOEs like Petrobras in Brazil have started incorporating these measures into their due diligence practices to prevent bribery schemes from happening again. [90] Citizens in resource-rich countries have also been using available information on corporate structures and beneficial ownership to provide public oversight of SOEs’ activities in the sector.

Box 14. Investigation into the ultimate owners of companies granted permits for coal transportation that are managed by a major state-owned enterprise in Mongolia

In Mongolia, the Opening Extractives programme supported the CSO Mongolia Data Club, in partnership with Open Society Forum, to organise a five-month training programme to bring together and strengthen data analysis capacity of teams of investigative journalists and data scientists. It focused on BOT, government spending and procurement processes, including for SOEs. Several teams looked into the governance and practices of the biggest coal exporter in Mongolia. One group focused on Mongolia’s government resolution no.362, implemented in 2023. The resolution grants mining companies the right to issue “C permits” to authorise a selection of coal transportation companies to transport coal between Mongolia and China.

The outcome of the tendering process announced by the State Procurement Office reported over 7,000 new permits issued. [91] The company in focus issued over 4,000 permits to 188 companies in the first quarter of 2023. Using Mongolia Data Club’s data analysis tools, the group of journalists identified that a significant proportion of these 188 companies were interrelated, and estimated that one-third of the 4,017 C permits issued by the company in January and February 2023 were “in the hands of a few people who are related to high-ranking government officials and the owners of foreign companies”. [92] The journalists used their research to hold the government accountable and question fair allocation of C permits. Mongolia Data Club continues to provide training to support local capacity in data journalism, and is now supporting the Government of Mongolia with their recently developed anti-corruption package to tackle challenges in Mongolia’s SOEs. [93]

Opening Extractives partnered with Mongolia Data Club in November 2022 for capacity-building training on understanding SOEs as well as governance opportunities and challenges of BOT in Mongolia

Turning extractives revenue into public services and infrastructure

When managed well, public revenue generated from extractive industries can be converted into investments in quality infrastructure and public services for citizens. Ensuring that skilled professionals and qualified companies are granted public contracts through transparent processes is essential to providing quality services. In contrast, opacity can have a directly detrimental impact on the services that citizens’ access.

For example, in Kenya, private power companies taking advantage of a loophole were able to hide the identity of foreign directors and shareholders benefiting from high electricity prices resulting in high costs for local citizens. [94] Knowing who ultimately benefits from public contracts is crucial to allowing effective oversight of public spending and increasing trust in governments. It is also essential to enable public procurement agencies to access a fuller picture of corporate ownership of bidders in order to prevent and detect any risks, such as potential conflicts of interest, collusion and bid-rigging. Integrating the use of beneficial ownership information into procurement processes is also in the interest of businesses, as it makes competition for public contracts fairer and can ensure any preferential procurement policies can be effectively implemented. [95]

Knowing who ultimately benefits from public contracts is crucial to effective oversight of public spending and increasing trust in governments.

Footnotes

[11] Organisation for Economic Co-operation and Development (OECD) (2016), Corruption in the Extractive Value Chain: Typology of Risks, Mitigation Measures and Incentives. Retrieved from: https://www.oecd-ilibrary.org/sites/9789264256569-en/1/1/4/index.html?itemId=/content/publication/9789264256569-en&_csp_=244b829344bef8386b8f431d59c2e7e4&itemIGO=oecd.

[12] OECD, Corruption in the extractive value chain.

[13] Transparency International (21 September 2016), “What Is Grand Corruption and How Can We Stop It?”. Retrieved from: https://www.transparency.org/en/news/what-is-grand-corruption-and-how-can-we-stop-it; Transparency International (no date), “What is Corruption?”. Retrieved from: https://www.transparency.org/en/what-is-corruption; OECD, Corruption in the extractive value chain.

[14] For more information, see: Ramandeep Kaur Chhina and Alanna Markle, Open Ownership (2024), Defining and capturing information on the beneficial ownership of investment funds. Retrieved from: https://www.openownership.org/en/publications/defining-and-capturing-information-on-the-beneficial-ownership-of-investment-funds.

[15] María Victoria Sibilla and Edgardo Litvinoff, Ruido (2023), “Los dueños del litio en Argentina”. Retrieved from: https://elruido.org/los-duenos-del-litio-en-argentina/.

[16] For more information on BOT of fisheries governance, see: Tymon Kiepe and Peter Low, Open Ownership (2024), Using beneficial ownership information in fisheries governance. Retrieved from: https://www.openownership.org/en/publications/using-beneficial-ownership-information-in-fisheries-governance. For more information on renewables infrastructure, see: Zinnbauer and Trapnell, Race to renewables.

[17] EITI (2021), Policy brief: The case for contract transparency - Africa. Retrieved from: https://eiti.org/documents/case-contract-transparency; OECD, Corruption in the Extractive Value Chain; Cari L. Votava, Jeanne M. Hauch and Francesco Clementucci, World Bank Group (2018), License to Drill: A Manual on Integrity Due Diligence for Licensing in Extractive Sectors. Retrieved from: https://documents1.worldbank.org/curated/en/514571530085582916/pdf/License-to-drill-a-manual-on-integrity-due-diligence-for-licensing-in-extractive-sectors.pdf.

[18] Will Fitzgibbon, International Consortium of Investigative Journalists (ICIJ) (2021), “Steinmetz and European, US advisers on trial for mining ‘corruption pact’ in West Africa”. Retrieved from: https://www.icij.org/investigations/panama-papers/steinmetz-and-european-us-advisers-on-trial-for-mining-corruption-pact-in-west-africa/.

[19] Patrick Radden Keefe, The New Yorker (2013), “Buried secrets”. Retrieved from: https://www.newyorker.com/magazine/2013/07/08/buried-secrets.

[20] ICIJ, “Steinmetz and European, US advisers on trial for mining ‘corruption pact’ in West Africa”.

[21] Public Eye (2024), “Steinmetz trial: a landmark verdict in the fight against corruption «made in Switzerland»”. Retrieved from: https://www.publiceye.ch/en/media-corner/press-releases/detail/steinmetz-trial-a-landmark-verdict-in-the-fight-against-corruption-made-in-switzerland.

[22] Victoria Bassetti, Kelsey Landau and Joseph Glandorf, Brookings (2020), “A master class in corruption: The Luanda Leaks across the natural resource value chain”. Retrieved from: https://www.brookings.edu/articles/a-master-class-in-corruption-the-luanda-leaks-across-the-natural-resource-value-chain/.

[23] Public Eye, “Steinmetz trial”.

[24] The term “local content” refers to “the share of employmentーor of sale to the sectorーlocally supplied at each stage of this chain, or the contribution of oil, gas or mining projects to the local, regional or national economy beyond the revenues paid to the government”. An estimated 90% of resource-rich countries have adopted local content policies to support the local economy and workforce. See: Tordo, S. et al (2013), “Local Content Policies in the Oil and Gas Sector”, World Bank, http://documents.worldbank.org/curated/en/549241468326687019/pdf/789940REVISED000Box377371B00PUBLIC0.pdf, quoted in EITI (2018), EITI and opportunities for increasing local content transparency. Retrieved from: https://eiti.org/documents/eiti-and-opportunities-increasing-local-content-transparency.

[25] These practices can also be observed in public procurement processes. For more information, see: Isabela Villamil, János Kertész and Mihály Fazekas (2024), “Collusion risk in corporate networks”, Scientific Reports, 14(3161). Retrieved from: https://doi.org/10.1038/s41598-024-53625-9.

[26] See EITI Requirement 2.2: EITI (2021), “Contract and license allocations”. Retrieved from: https://eiti.org/guidance-notes/contract-and-license-allocations.

[27] Alanna Markle and Tymon Kiepe, Open Ownership (2022), Who Benefits? How company ownership data is used to detect and prevent corruption. Retrieved from: https://www.openownership.org/en/publications/who-benefits-how-company-ownership-data-is-used-to-detect-and-prevent-corruption/; OCCRP (2022), “Beneficial Ownership Data Is Critical In The Fight Against Corruption”. Retrieved from: https://www.occrp.org/en/beneficial-ownership-data-is-critical-in-the-fight-against-corruption/.

[28] Aaron Sayne, Alexandra Gillies and Andrew Watkins, NRGI (2017), “Twelve Red Flags: Corruption Risks in the Award of Extractive Sector Licenses and Contracts”, p. 12, 27, 18. Retrieved from: https://resourcegovernance.org/publications/twelve-red-flags-corruption-risks-award-extractive-sector-licenses-and-contracts.

[29] NRGI (2021), Step 4 Research Guide: Decision to Extract, Licensing and Contracting. Retrieved from: https://anticorruptiontool.resourcegovernance.org/wp-content/uploads/2023/12/NRGI_DiagnosingCorruption_Module_Licencing.pdf.

[30] Transparency International Canada, Publish What You Pay Canada and Canadians for Tax Fairness (2022), Snow-washing, Inc: How Canada is marketed abroad as a secrecy jurisdiction. Retrieved from: https://www.taxfairness.ca/sites/default/files/resource/2022-03-16_report_-_snow-washing-inc.pdf.

[31] For more examples of red flags that can be found in beneficial ownership datasets, see: Stephen Abbott Pugh and Kathryn Irish, Open Ownership (26 February 2024), “Spotting red flags in beneficial ownership datasets”. Retrieved from: https://www.openownership.org/en/blog/spotting-red-flags-in-beneficial-ownership-datasets/.

[32] This might, for example, be measured by the Tax Justice Network Financial Secrecy Index. See: Tax Justice Network (no date), “Financial Secrecy Index 2022”. Retrieved from: https://fsi.taxjustice.net/.

[33] For a discussion on the issue of legal minors as beneficial owners, see: Alanna Markle, Open Ownership (21 September 2023), “Too young to count? Legal minors as beneficial owners”. Retrieved from: https://www.openownership.org/en/blog/too-young-to-count-legal-minors-as-beneficial-owners/.

[34] Giovanna Marcolongo and Diego Zambiasi, UNU-WIDER (2022), Incorporation of offshore shell companies as an indicator of corruption risk in the extractive industries. Retrieved from: https://doi.org/10.35188/UNU-WIDER/2022/145-7.

[35] EITI (2023), EITI Standard 2023 – Part 1: Principles and requirements, p. 20. Retrieved from: https://eiti.org/sites/default/files/2024-04/2023%20EITI%20Standard_Parts1-2-3.pdf.

[36] EITI and Open Ownership, Opening Extractives: Progress Report 2022/23.

[37] Directorio Legislativo (no date), “Joining the Dots – How does the tool work?”. Retrieved from: https://peps.directoriolegislativo.org/colombia/tool.

[38] Directorio Legislativo (no date), “Joining the Dots – How does the tool work?”. Retrieved from: https://peps.directoriolegislativo.org/nigeria/tool.

[39] Directorio Legislativo (no date), “Joining the Dots – Initial Findings”. Retrieved from: https://peps.directoriolegislativo.org/nigeria/analytics.

[40] Directorio Legislativo (unpublished), Joining the Dots with Politically Exposed Persons in Nigeria: Narrative Report.

[41] NORPRA (11 December 2022), “Is Ghana Effectively Using Beneficial Ownership Data For Due Diligence in its Extractive Sector?”, Modern Ghana. Retrieved from: https://www.modernghana.com/news/1200348/is-ghana-effectively-using-beneficial-ownership.html.

[42] Reuters (17 October 2022), “Zambia restricts number of mining licences per company to five”, The Northern Miner Group. Retrieved from: https://www.mining.com/web/zambia-restricts-number-of-mining-licences-per-company-to-five.

[43] Reuters (29 March 2022), “Zambia to cap number of mining licences issued to single firms”. Retrieved from: https://www.reuters.com/world/africa/zambia-cap-number-mining-licences-issued-single-firms-2022-03-29/.

[44] See: OCCRP (no date), “OCCRP Aleph”. Retrieved from: https://aleph.occrp.org/.

[45] EITI, “Contract and license allocations”.

[46] OECD, Corruption in the Extractive Value Chain, p. 49.

[47] CivilNet (23 December 2022), “Ո՞ր հանքարդյունաբերողներն են խուսափում բացահայտել իրենց իրական սեփականատերերին”. Retrieved from: https://www.civilnet.am/news/687091/%D5%B8%D5%9E%D6%80-%D5%B0%D5%A1%D5%B6%D6%84%D5%A1%D6%80%D5%A4%D5%B5%D5%B8%D6%82%D5%B6%D5%A1%D5%A2%D5%A5%D6%80%D5%B8%D5%B2%D5%B6%D5%A5%D6%80%D5%B6-%D5%A5%D5%B6-%D5%AD%D5%B8%D6%82%D5%BD%D5%A1%D6%83%D5%B8%D6%82%D5%B4-%D5%A2%D5%A1%D6%81%D5%A1%D5%B0%D5%A1%D5%B5%D5%BF%D5%A5%D5%AC-%D5%AB%D6%80%D5%A5%D5%B6%D6%81-%D5%AB%D6%80%D5%A1%D5%AF%D5%A1%D5%B6-%D5%BD%D5%A5%D6%83%D5%A1%D5%AF%D5%A1%D5%B6%D5%A1%D5%BF%D5%A5%D6%80%D5%A5%D6%80%D5%AB%D5%B6/?fbclid=IwAR0QB1ZyeK5gZn7aRV3evnCC13Pm22brGyg3MNXS-XakrXbgFVf6XSWj0U8.

[48] Julie Rialet and Mark Hays, Open Ownership (2023), What’s in it for business? The US case: Lessons from private sector and civil society advocacy for beneficial ownership transparency reforms. Retrieved from: https://www.openownership.org/en/publications/whats-in-it-for-business-the-us-case/.

[49] NRGI (2020), Report Annex: Annex 1. Global reporting standards that address aspects of extractives supplier transparency. Retrieved from: https://resourcegovernance.org/sites/default/files/documents/suppliers_annex_1_en.pdf.

[50] Robert Pitman and Kaisa Toroskainen, NRGI (2020), Beneath the Surface: The Case for Oversight of Extractive Industry Suppliers. Retrieved from: https://resourcegovernance.org/sites/default/files/documents/beneath_the_surface.pdf.

[51] Votava et al. (2018), License to Drill.

[52] Andrew Scott and Sam Pickard, ODI (19 August 2020), “FAQ 3: oil and gas, poverty, the environment and human rights”. Retrieved from: https://odi.org/en/about/our-work/climate-and-sustainability/faq-3-oil-and-gas-poverty-the-environment-and-human-rights/; Zinnbauer and Trapnell, Race to renewables; Financial Action Task Force (2021), Money Laundering from Environmental Crime. Retrieved from: https://www.fatf-gafi.org/en/publications/Environmentalcrime/Money-laundering-from-environmental-crime.html.

[53] INTERPOL (2023), “Organized crime groups pushing environmental security to a tipping point”. Retrieved from: https://interpol.int/en/News-and-Events/News/2023/Organized-crime-groups-pushing-environmental-security-to-tipping-point.

[54] United Nations Office on Drugs and Crime (no date), Response Framework on Illegal Mining and the Illicit Trafficking in Precious Metals. Retrieved from: https://www.unodc.org/documents/Wildlife/UNODC_Response_Framework_Minerals.pdf; Odd Berne Malme and Kosyo Ivanov, Global Initiative against Transnational Organized Crime (2023), “Corruption and crime: Measuring the links”. Retrieved from: https://globalinitiative.net/analysis/corruption-crime-ocindex/.

[55] Ernest Bako Wubonto, B&FT (12 December 2022), “Limestone-rich Krobo communities deprived of development”. Retrieved from: https://thebftonline.com/2022/12/12/limestone-rich-krobo-communities-deprived-development/.

[56] Alanna Markle, Shining a light on company ownership.

[57] World Bank Group (2023), Business Ready (B-Ready) Manual and guide. Retrieved from: https://thedocs.worldbank.org/en/doc/5d79ca28ad482b1a9bc19b9c3a9c9e19-0540012023/original/B-READY-Manual-and-Guide.pdf.

[58] Andrew Irvine, EITI (13 December 2023), “From expectations to ESG: Strengthening corporate accountability”. Retrieved from: https://eiti.org/blog-post/expectations-esg-strengthening-corporate-accountability.

[59] Zinnbauer and Trapnell, Race to Renewables.

[60] Green Hydrogen Organisation (2023), Green Hydrogen Standard 2.0: The Global Standard for Green Hydrogen and Green Hydrogen Derivatives. Retrieved from: https://www.greenhydrogenstandard.org/sites/default/files/2023-12/GH2_Standard_A5_Nov%202023_DIGITAL.pdf.

[61] EITI (2021), Statement by companies on beneficial ownership transparency. Retrieved from: https://eiti.org/documents/statement-companies-beneficial-ownership-transparency.

[62] EITI (2022), Expectations for EITI supporting companies. Retrieved from: https://eiti.org/documents/expectations-eiti-supporting-companies.

[63] EITI (18 February 2022), “Stronger commitments on transparency for commodity traders, mining, oil and gas companies supporting the EITI”. Retrieved from: https://eiti.org/news/stronger-commitments-transparency-commodity-traders-mining-oil-and-gas-companies-supporting.

[64] EITI (2023), 2023 Assessment of EITI supporting companies. Retrieved from: https://eiti.org/documents/2023-assessment-eiti-supporting-companies.

[65] EITI (2021), Social and environmental expenditures by extractive companies. Retrieved from: https://eiti.org/guidance-notes/social-and-environmental-expenditures.

[66] Anna Fleming, NRGI (19 December 2019), “New Countries Report in Latest Natural Resource Revenue Dataset”. Retrieved from: https://resourcegovernance.org/articles/new-countries-report-latest-natural-resource-revenue-dataset.

[67] U4 (no date), U4 online course, “Corruption in the extractive industries: an overview”. Retrieved from: https://www.u4.no/courses/corruption-in-the-extractive-industries; NRGI (no date), “Chapter Five – Money Flows: Managing extractive revenues”, in Covering Extractives: An online guide to reporting on natural resources. Retrieved from: https://coveringextractives.org/handbook/chapter-5/.

[68] UN Trade & Development (UNCTAD) (28 September 2020), “Africa could gain $89 billion annually by curbing illicit financial flows”. Retrieved from: https://unctad.org/news/africa-could-gain-89-billion-annually-curbing-illicit-financial-flows.

[69] Tax Justice Network (2023), The State of Tax Justice 2023. Retrieved from: https://taxjustice.net/reports/the-state-of-tax-justice-2023/.

[70] Open Ownership (2023), Interview with an anonymous representative from an African tax agency.

[71] CTPD (2023), Enhancing Beneficial Ownership Transparency In Zambia’s Mining Sector For Enhanced Domestic Resource Mobilization. Retrieved from: https://ctpd.org.zm/?sdm_process_download=1&download_id=2003.

[72] Marie Chêne, U4 (2016), Linkages between corruption and commodity trading. Retrieved from: https://www.u4.no/publications/linkages-between-corruption-and-commodity-trading.pdf; EITI (no date), “Commodity trading: Shedding light on how oil, gas and minerals are bought and sold”. Retrieved from: https://eiti.org/commodity-trading.

[73] Dan Ngabirano, UN Office of the Special Adviser on Africa (2022), Tackling Illicit Financial Flows in Africa Arising from Taxation and Illegal Commercial Practices. Retrieved from: https://www.un.org/osaa/sites/www.un.org.osaa/files/tackling_iffs_in_tax_reform_and_illegal_commercial_practices_-_nov_2022.pdf; UNCTAD, “Africa could gain $89 billion annually by curbing illicit financial flows”.

[74] The World Bank (2024), “World Development Indicators”. Retrieved from: https://databank.worldbank.org/reports.aspx?source=World-Development-Indicators#.

[75] D. Porterand C. Anderson, OECD (2021), Illicit financial flows in oil and gas commodity trade: Experience, lessons and proposals, p. 14-15. Retrieved from: https://www.oecd.org/development/accountable-effective-institutions/illicit-financial-flows-oil-gas-commodity-trade-experience.pdf.

[76] EITI, “Commodity trading”.

[77] EITI (2023), EITI Requirements. Retrieved from: https://eiti.org/eiti-requirements.

[78] Chêne, Linkages between corruption and commodity trading.

[79] EITI (2020), Reporting guidelines for companies buying oil, gas and minerals from the state. Retrieved from: https://eiti.org/sites/default/files/2022-01/en_eiti_gn_4.2.pdf.

[80] Policy Alert (no date), “Domestic Trading Companies In Nigeria’s Crude Swap Deals”. Retrieved from: https://policyalert.org/download/1460/#inbox/_blank.

[81] Oladeinde Olawoyin, Premium Times Nigeria (27 November2021), “Pandora Papers: Inside the crime-infested life of Diezani’s ally, Walter Wagbatsoma”. Retrieved from: https://www.premiumtimesng.com/news/headlines/497667-pandora-papers-inside-the-crime-infested-life-of-diezanis-ally-walter-wagbatsoma.html?tztc=1.

[82] Emmanuel Addeh, This Day (2023), “With N30tn Losses to Petrol Subsidy, Oil Theft, NEITI Calls for Tracking of Nigeria’s Crude Swap Deals”. Retrieved from: https://www.thisdaylive.com/index.php/2023/04/14/with-n30tn-losses-to-petrol-subsidy-oil-theft-neiti-calls-for-tracking-of-nigerias-crude-swap-deals; Omon-Julius Onabu, This Day (2023), “Why NNPC Should Come Clean on Oil Swap Deals, Says Policy Alert”. Retrieved from: https://www.thisdaylive.com/index.php/2022/12/03/why-nnpc-should-come-clean-on-oil-swap-deals-says-policy-alert; Policy Alert, “Domestic Trading Companies In Nigeria’s Crude Swap Deals”.

[83] EITI (no date), “State-owned enterprises: Strengthening accountability of state participation in the extractive sector”. Retrieved from: https://eiti.org/state-owned-enterprises.

[84] Chêne, Linkages between corruption and commodity trading.

[85] EITI (2020), State participation and state-owned enterprises. Retrieved from: https://eiti.org/sites/default/files/2022-02/en_eiti_gn_2.6.pdf.

[86] Robert Pitman and Kaisa Toroskainen, NRGI (2018), “BHP, Others Increase Scrutiny of Subcontracting Corruption Risks”. Retrieved from: https://resourcegovernance.org/articles/bhp-others-increase-scrutiny-subcontracting-corruption-risks.

[87] Votava et al. (2018), License to Drill.

[88] EITI and Open Ownership (2023), Defining and capturing data on the ownership and control of state-owned enterprises. Retrieved from: https://oo.cdn.ngo/media/documents/Defining_and_capturing_data_on_ownership_and_control_of_state_owned_enterprise_oLnzCsB.pdf.

[89] EITI and Open Ownership, Defining and capturing data on the ownership and control of state-owned enterprises.

[90] NRGI (2022), Anticorruption Guidance for Partners of State-Owned Enterprises. Retrieved from: https://soe-anticorruption.resourcegovernance.org/.

[91] PressReader (2023), “Over 1600 C permits to be granted for coal trade exchange”. Retrieved from: https://www.pressreader.com/mongolia/the-ub-post/20230111/281582359730050.

[92] T. Bayar, Polit.mn (28 April 2023), “Тэнцүү олгосон нэртэй с зөвшөөрлийн ард сингапур, хятад ноёд туйлж байн”. Retrieved from: https://www.polit.mn/a/101369.

[93] Delgermaa Boldbaatar and Erdenechimeg Dashdorj, Open Contracting Partnership (11 October 2023), “Digging out data to shine a light on public buying in Mongolia”. Retrieved from: https://www.open-contracting.org/2023/10/11/digging-out-data-to-shine-a-light-on-public-buying-in-mongolia/.

[94] Stephen Letoo, Citizen Digital (10 August 2023), “Revealed: MP Suleiman Shahbal Among Businessmen Linked To High Cost Of Electricity”. Retrieved from: https://www.citizen.digital/news/revealed-mp-suleiman-shahbal-among-businessmen-linked-to-high-cost-of-electricity-n325302.

[95] Eva Okunbor and Tymon Kiepe, Open Ownership (2021), Beneficial ownership data in procurement. Retrieved from: www.openownership.org/en/publications/beneficial-ownership-data-in-procurement/.