Trusts and beneficial ownership: Guidance for data collection and sharing

Trust registries

Generally, trusts are created to manage assets and distribute the benefits and income derived from them within the terms laid down by the settlor. [4] When considering transparency of beneficial ownership and the role of trusts, it can be helpful to distinguish between:

I. the beneficial ownership of the parties to the trust (where they are legal entities or arrangements);

II. the beneficial ownership of the trust;

III. the beneficial ownership of assets held in trust.

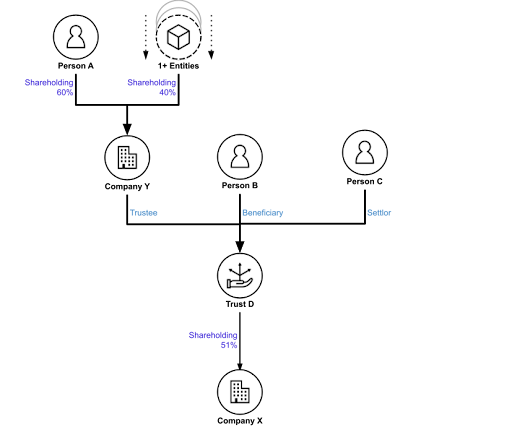

In reality, these may overlap depending on legal definitions, and information about (I) will be necessary to clarify (II) and (III). This can be seen in the following example:

To establish who the beneficial owners of Company X are (III), we also need to know the identity of the parties involved in Trust D (II). One of the parties, the trustee, is itself a company. Who the beneficial owners of Company Y are (I) is then relevant. Ultimately, whether Person A’s indirect relationship with Company X constitutes beneficial ownership will then depend on the applicable legal definitions.

The FATF supports this kind of transparency of trust arrangements, and the parties to them, in its Recommendation 25:

[C]ountries should ensure that there is adequate, accurate and up-to-date information on express trusts and other similar legal arrangements including information on the settlor(s), trustee(s) and beneficiary(ies), that can be obtained or accessed efficiently and in a timely manner by competent authorities. [5]

This information may be maintained by trustees and communicated on demand. However, experience from implementation of the FATF’s Recommendation 24 suggests that the information becomes easier to use and access in a timely manner if a well-defined subset of the information is collected and shared via a registry in a structured format.

Trusts can be registered via a dedicated trusts registry or a general registry for corporate vehicles, which has been extended to include such arrangements. Here, “trust registry” or “registry” are used to refer to both approaches.

This guidance focuses on how to collect relevant information about parties to a trust (and potentially their onward beneficial ownership) when trust arrangements are registered. Particularly for beneficiaries, regulations should be clear about the conditions under which a person identified by the trustee(s) becomes registrable. [6] Here “registrable person” is used to refer to a person meeting such conditions. What these conditions should be, and how they relate to a relevant definition of “beneficial owner”, are not within the scope of this guidance.

Footnotes

[4] The term “settlor” refers to the role that an individual plays when creating a trust and transferring assets to it. Other equivalent terms, such as “founder”, “grantor’’, and “trustor”, also exist.

[5] FATF, The FATF Recommendations: International standards on combating money laundering and the financing of terrorism & proliferation (Paris: FATF, updated 2023), 22, https://www.fatf-gafi.org/content/dam/fatf-gafi/recommendations/FATF%20Recommendations%202012.pdf.coredownload.inline.pdf.

[6] For more information on the specific intricacies of beneficiaries, please see the section “Beneficiaries” in Chapter 2: Scope of R.25: Trusts and other similar legal arrangements: FATF, Guidance for a risk-based approach: Beneficial ownership and transparency of legal arrangements (Paris: FATF, 2024), https://www.fatf-gafi.org/content/dam/fatf-gafi/recommendations/Guidance-Beneficial-Ownership-Transparency-Legal-Arrangements.pdf.coredownload.inline.pdf.