Verification of beneficial ownership data

Overview

To maximise the impact of beneficial ownership registers, it is important that users and authorities can trust that the data contained in a register broadly reflects the true and up-to-date reality of who owns or controls a particular company.

Verification is the combination of checks and processes that a particular disclosure regime opts for to ensure that the beneficial ownership data is of high quality, meaning it is accurate and complete at a given point in time.

Verification involves creating systems to check that the information submitted to the register is at the very minimum plausible; appears in the correct format; is free from omissions; has been provided by a relevant, authorised person; and is ideally free from all error and falsehoods.

For the majority of companies with relatively simple ownership structures, determining and verifying their beneficial ownership (BO) will be a relatively straightforward exercise. Determining BO is more challenging for the minority of companies that have complex and often transnational ownership structures involving many different legal entities. In such cases, it may not be possible to reach 100% certainty that the disclosed BO data represents an accurate and complete picture.

A BO disclosure is a statement that is made about BO at a certain point in time, rather than an absolute truth. This is the case for many other types of information that are routinely filed by companies, such as statements of financial activity. Therefore, a good verification system is required so that users can rely on the data. Verification systems increase reliability by:

- providing clarity about the provenance of the data and what checks have been done;

- reducing the risks associated with the data being false;

- triggering the appropriate alarms when BO data is false or suspicious.

There is no one-size-fits-all solution to verification, and the right verification system for a particular disclosure regime will depend on the specific local context. This document aims to set out overarching principles that underpin all effective verification systems. In addition, those who work on beneficial ownership transparency at times use “verification” to refer to a number of different things. This briefing offers a common vocabulary to those working on the verification of beneficial ownership data.

Types of incorrect data that verification systems can address

A good verification system will address:

- accidental error: data that is entered wrongly by accident (e.g. spelling a country of residence incorrectly);

- deliberate falsehood: false data entered with the intent to deceive.

There are different methods and mechanisms for verification, and they have different levels of effectiveness when it comes to accidental error and deliberate falsehoods. Generally, accidental errors are easier to address than deliberate falsehoods.

Types of verification checks

Verification breaks down into a number of checks that can be done:

- at the point of submission of BO information;

- after the submission of BO information.

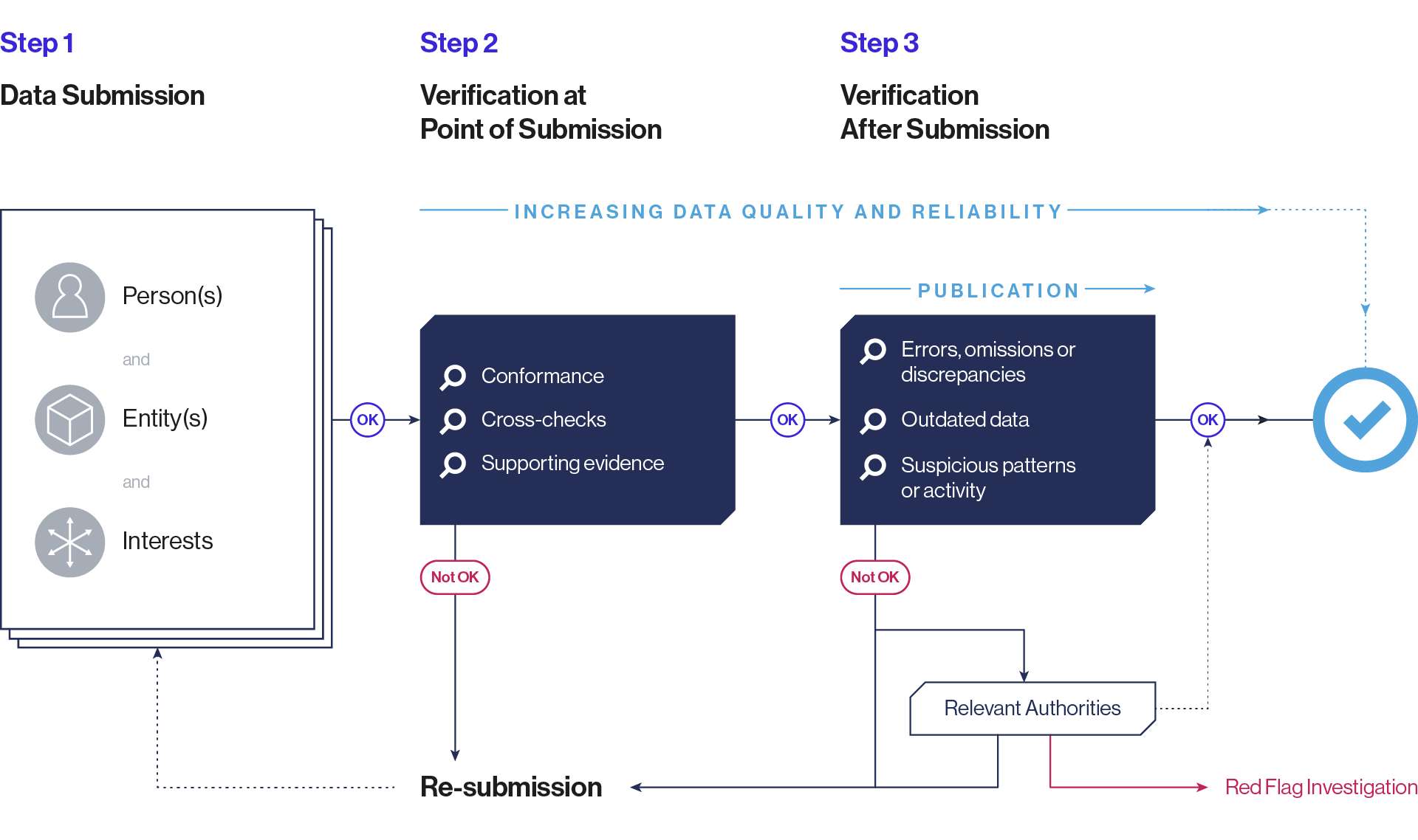

Figure 1: Beneficial ownership data verification steps

Step 1: Data submission

A beneficial ownership disclosure is submitted as information about a person, an entity and the control relationship between them.

Step 2: Verification at point of submission

A number of verification checks (conformance, cross-checks and supporting evidence checks) are conducted at the point of submission. Data that fails these checks requires resubmission. Data that passes these checks undergoes a number of checks following submission.

Step 3: Verification after submission

Errors, omissions and discrepancies are reported to the registrar and require correction or resubmission; outdated data requires resubmission, or a confirmation that it is still correct; suspicious activity or patterns in the data are passed onto an FIU, and triaged as being a false positive, requiring resubmission, or escalated for further investigation.

Verification is a constant process: with each verification check, data quality and reliability increases. All verification measures should be enforced by a comprehensive, proportionate and dissuasive sanctions regime.