Who benefits? How company ownership data is used to detect and prevent corruption

Using beneficial ownership data to reduce corruption

The first central registers of beneficial ownership were launched as recently as 2015. Despite this short history, actors from grassroots activists to investigators in financial intelligence units are using beneficial ownership data to tackle corruption.

Broadly, beneficial ownership data is used in three ways: investigating corruption; informing decisions to reduce corruption risks; and using analysis to deliver anti- corruption insights. Each of these is explored below. In many cases, the value of ownership data to counter corruption comes from its integration with other information, while innovation in data use is key to expanding the horizons of transparency and accountability efforts on every front.

Making the data in beneficial ownership registers public – for the extractive industries and the economy more broadly – maximises its potential for impact by expanding access to all potential data users, from foreign law enforcement to journalists. Public access increases the opportunities to make connections between ownership information across jurisdictions and with other data sources to carry out investigations and derive insights.

Investigating corruption, following the money

All forms of political corruption involve the abuse of power for private gain, and they usually involve some type of conflict of interest for those who make the decisions. Investigations by financial investigative units, law enforcement and journalists can help uncover these. In many of these investigations, data users follow the money, tracing transactions from bank account to bank account to link financial flows to individuals, and testing novel, data-driven approaches to this work.[5]

Knowing who owns companies can prevent investigators reaching a dead end. For example, in 2018, the UK issued an unexplained wealth order using evidence from the UK’s beneficial ownership register against a politically exposed person (PEP) from Azerbaijan.

The register showed that the wife of an Azerbaijani official – who had been jailed in 2016 for the embezzlement of the oil-rich nation’s public funds – had beena beneficial owner of a company which owned a golf club that was suspected to be purchased with laundered funds.[6] In December 2020, she lost a Supreme Court appeal to overturn the wealth order.[7] Assets worth GBP 3.2 million have been seized pending the outcome of forfeiture proceedings by the National Crime Agency.[8]

In cases such as this, company ownership information provides a critical piece of the puzzle to identify links between different individuals and legal entities. The utility of beneficial ownership data is expanded when combined with other information, such as real estate and other asset registers. For example, the independent media and anti-corruption investigation organisation Bihus.info investigated a Ukrainian MP, combining data from Ukraine’s asset and beneficial ownership registers to examine the source of UAH 1.2 million (approximately USD 42,000) in annual rental income that the MP had declared. They found that the source of the reported income was likely from proceeds of corruption. The High Anti-Corruption Court of Ukraine also investigated this case; in 2021, it ruled that the income was illegitimately acquired and should be subject to civil forfeiture, the first time this mechanism was used since it was introduced in Ukraine in 2019.[9]

Surveys of law enforcements’ views of central beneficial ownership registers highlight the time saved when conducting investigations through being able to efficiently access beneficial ownership information from a central register, rather than having to request it from each individual company being investigated. Interviews with eight law enforcement organisations, conducted three years after the launch of the UK’s public beneficial ownership register, revealed that all interviewees had used the register to inform criminal investigations.

Additionally, most law enforcement organisations said that the register had a positive effect on their work: “The introduction of the register [...] has made it quicker and easier to obtain information. Therefore, the process of identifying and developing an understanding of individuals that control corporate entities and the corporate networks of which they form part has been made more efficient”.[10]

Public registries can also be a more efficient alternative to time and resource consuming mechanisms for sharing information internationally, such as through mutual legal assistance requests.[11] Because the proceeds of corruption are frequently laundered and invested in assets outside the country where corruption has occurred, international cooperation and the sharing of beneficial ownership data is essential. To illustrate, the new UK beneficial ownership register for overseas entities owning UK property was hailed as a useful anti-corruption tool in Nigeria.[12] When national registers provide structured and interoperable data, beneficial ownership data can be readily combined with other data, such as procurement data, or with beneficial ownership data from other national registers to improve visibility of transnational corporate structures. This is demonstrated by the Open Ownership Register, the world’s first transnational beneficial ownership register, currently combining data from four national registers.[13]

The use of beneficial ownership data by Zambia’s Financial Intelligence Centre in investigating corruption[14]

A frontrunner in the region, Zambia launched its beneficial ownership register at the Patents and Companies Registration Agency (PACRA) in 2019. Since its launch, the register has become a frequently consulted resource by staff members of Zambia’s Financial Intelligence Centre (FIC). The FIC identifies true company owners by following the money as part of its process of conducting financial analysis. In many cases, this differs from information disclosed to the register. For example, the FIC often identifies: foreign nationals as the true beneficial owners where Zambian nationals have been disclosed; beneficial owners where none have been declared; or additional beneficial owners to those declared to the register. This is in part due to low compliance. Around a third of companies have submitted information, which the Zambian government is currently trying to improve through amending legislation and raising awareness.

Nevertheless, “the register is key,” according to the FIC. Investigations can be initiated by reports of suspicious transactions. “This could be a bribe, so then we work our way backwards by checking the registry.” When the FIC finds different beneficial owners than what is in the register, this raises a red flag for further investigation.

Along with shareholder and director information, beneficial ownership declarations provide an extra dimension for identifying links between individuals and entities, which generate leads and help inform and broaden the scope of the investigation. “The beneficial ownership register in our day to day work is very important in that it helps us to know the scope,” a FIC analyst said. “Once you identify a person to be a beneficial owner of an entity, and you float that name with the register, you are able to see more companies linked to the same individual [...] You may be looking at one company not knowing that there are other companies, and your financial analysis has to broaden,” the staff member added. “You have to target those entities, and review whatever contracts they have been awarded by the government [...] It helps you understand what potentially as a country you could have lost.”

Although the FIC conducts its own verification of information, they welcome PACRA’s efforts to improve the accuracy of information in the central beneficial ownership register and to collect more information on foreign companies, as they believe this will likely save the FIC time – a precious asset in investigations.

The Zambian government is currently strengthening its disclosure system with support from Opening Extractives.

Beneficial ownership data is also used by journalists in investigations. The Organized Crime and Corruption Reporting Project (OCCRP) has developed an innovative data platform called Aleph to help journalists follow the money using “detailed data about persons of interest, companies, financial transactions, and more”.[15] Aleph prioritises datasets that assist users in tracking assets and company ownership, often across borders. It includes data from over 50 company registries, including central beneficial ownership registers, and allows journalists to contextualise information they obtain about people, companies or assets of interest. This can help identify leads to potential corruption cases.

For example, when journalists acquire information about company-owned bank accounts or properties, they can use Aleph to cross-check the names of companies listed as owners with documents and sources, including beneficial ownership register beneficial ownership register data, to find the registered owner, and compare it to other records, such as property registers and lists of PEPs. Connections in the data do not establish wrongdoing, but they can generate leads that merit investigation. For example, when the wealth of a public official is disproportionately large compared to their official income, this can be a red flag for corruption.[16]

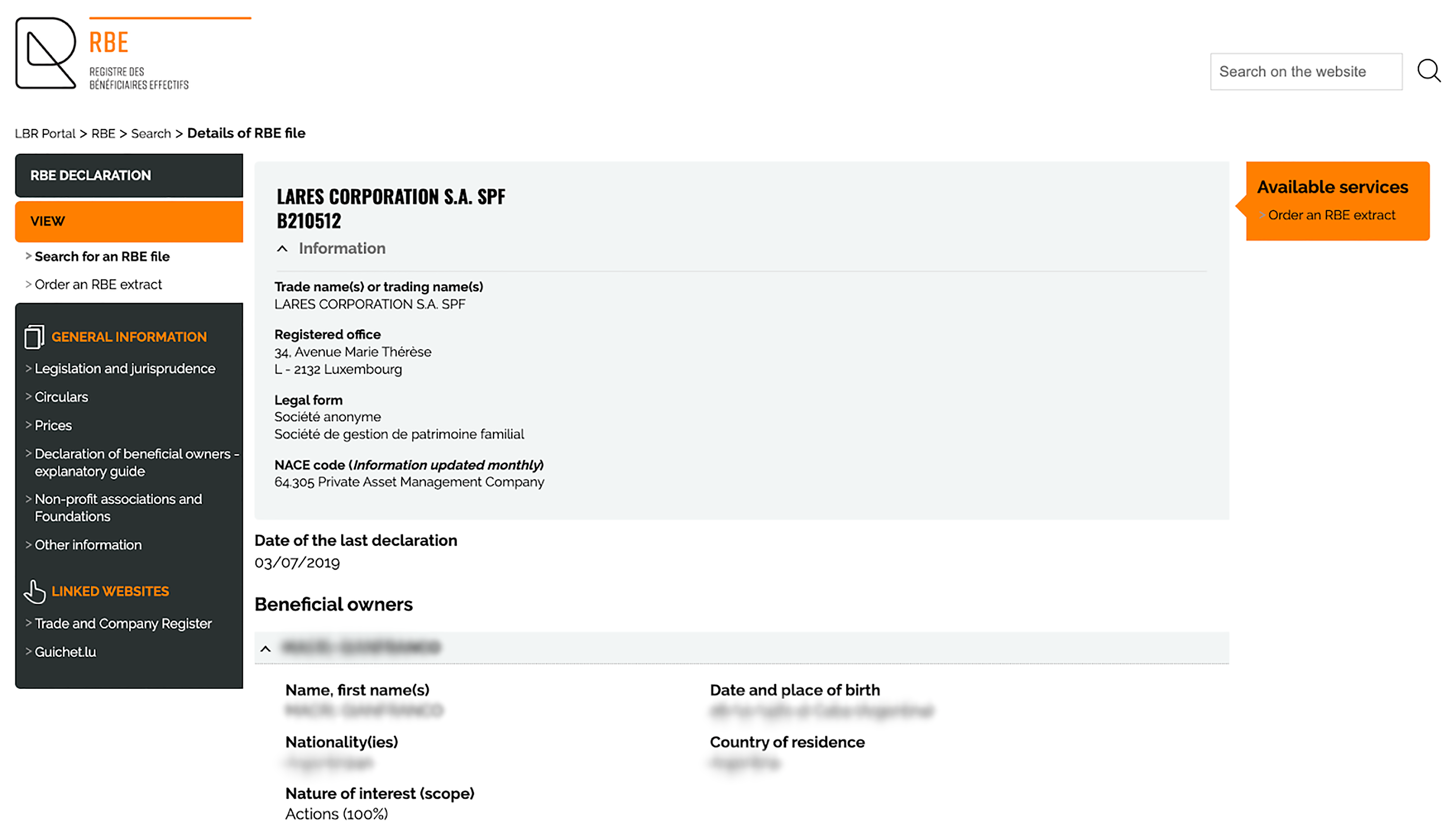

Luxembourg’s public register used by journalists to investigate potential corruption involving Argentinian wind farms[17]

Since 2018, law enforcement has been investigating former Argentine president Mauricio Macri’s brother, Gianfranco Macri, and at least one official from his government in connection with allegedly corrupt deals to buy and sell six wind farms. According to OCCRP, the deals are “thought to have netted the former president and his relatives around USD 70 million”. Data from Luxembourg’s public beneficial ownership register has been instrumental to advancing this ongoing investigation.[18]

In 2021, OCCRP and Argentina’s La Nación newspaper published a story revealing that Gianfranco Macri is listed as the beneficial owner of a company registered in Luxembourg called Lares Corporation S.A. SPF. One of the journalists leading the investigation found the name by reviewing a list of Argentine nationals who were registered as beneficial owners in Luxembourg’s beneficial ownership data. After finding this connection, the team discovered that Lares Corporation was part of a chain of entities registered in Argentina, Luxembourg and Spain that were used to buy and sell the wind farms during Mauricio Macri’s presidency.

According to the OCCRP story, it had already been reported by Argentinian news outlet Perfil that a corporate construction company associated with the Macris was used in the wind farm deals and was owned by a Luxembourg company called Rainbow Finance, but neither journalists nor law enforcement had been able to establish a connection between Rainbow Finance and the Macri family. The connection was the Lares Corporation, which had invested in Rainbow Finance. The story quotes a source close to the law enforcement investigation: “the discovery of the new Luxembourg company could be a key piece of evidence in understanding how the Macris benefited from the scheme at a time when the probe has stalled”.[19]

Responding to the media report, a spokesperson for the family confirmed that the family used Lares Corporation to invest in renewable energy and that Lares invested in the wind farms through Rainbow Finance, but that Rainbow Finance was “a shared investment fund” and claimed low levels of investment by Gianfranco Macri. The spokesperson also said that Lares Corporation had been properly declared in Argentina.

Following this story’s publication, Argentinian journalists shared documentation of their discovery with the judge overseeing the case and testified in court. The judge sent a formal request for information[20] from Luxembourg and Spain based on the submission of this new evidence. A journalist who worked on the story noted that having the information about Lares Corporation available in Luxembourg’s public register made writing it possible. While making the data in the OpenLux project searchable by the names of beneficial owners was key to finding Gianfranco Macri’s link to Lares Corporation, the OCCRP and Le Monde had to download and restructure the millions of data entries it contains.

This case study was written before the judgement of the Court of Justice of the European Union on 22 November 2022 in Joined Cases C-37/20 and C-601/20. Following the judgement, “access to the RBE website via the internet is temporarily suspended.”[21]

Lares Corporation S.A. SPF on the Luxembourg beneficial ownership register

Source: www.lbr.lu/mjrcs-rbe, 13 October 2022

Reducing corruption risks through informed decision-making

Each day, governments and businesses make decisions about how to allocate resources; with whom to do business; and where not to invest. Placing beneficial ownership information in the hands of those with due diligence responsibilities can help uncover suspicious links, corruption and conflicts of interest that escape other routine checks.

Delivering clean procurement

Beneficial ownership information is used in government procurement processes to help identify who is behind the companies that jurisdictions select to provide goods, works and services. Procuring authorities use beneficial ownership data to identify conflicts of interest that may arise when there are links between companies bidding for tenders and politically connected individuals, and has the added benefit of being able to identify signs of fraud, such as bid-rigging.[22]

In the extractive sector, suppliers of goods and services, ranging from large multinationals to small local firms, undertake work valued in the billions of dollars for companies, state-owned enterprises and governments. Supplier contracts represent a major channel for local economic benefits from extraction, but they also pose significant corruption risk: a review of over 40 extractive industry corruption cases found that suppliers were involved in abuses in at least 29 countries across five continents.[23] Procurement transparency improves oversight of suppliers, and the publication of ownership data can help ensure that local procurement contracts are awarded fairly.

Publishing ownership data of companies that have submitted bids and received government contracts further increases transparency and can create a deterrent effect.[24] A World Bank study using data from 88 developing countries found that greater transparency in public procurement led to more firms participating in procurement markets as well as firms paying fewer and smaller kickbacks to officials; it was also associated with more participation among smaller firms with fewer resources to navigate corrupt systems.[25] Publishing beneficial ownership data on companies bidding for or being awarded government contracts is an approach being taken in jurisdictions such as Kenya and Slovakia.[26]

The European Union (EU) has used the ARACHNE, an “integrated IT tool for data mining and data enrichment” to carry out due diligence for its Social Fund and its Regional Development Fund.[27] ARACHNE uses beneficial ownership information along with other company information to “identify, based on a set of risk indicators, the projects, beneficiaries, contracts and contractors which might be susceptible to risks of fraud, conflict of interest and irregularities”.[28] ARACHNE’s implementation precedes the implementation of central registers in many EU member states, and uses a commercial beneficial ownership dataset.

Strengthening governance of extractives licenses

Competition for exploration and production licenses within extractive industries creates large incentives for corruption. Companies can seek unfair advantages using bribes or collusion, while government decision makers can leverage their power for private financial gain.[29] Government officials responsible for licensing decisions can use beneficial ownership information in a few ways.

It can inform decisions, such as whether to deny, revoke or decline to renew company licenses, in cases where the information points to potential corruption, such as conflicts of interest and bribery. It can also help identify regulatory compliance violations or fraud, such as instances when two or more companies with the same owners are colluding to drive down the prices of oil and gas leases.

Moreover, beneficial ownership data could help in detecting conflict of interest in the evaluation of environmental impact assessments of extractive projects, which are preconditions for the issuance of licenses. In some cases, information from the jurisdiction’s own beneficial ownership register may be sufficient to raise red flags about conflicts of interest. In other instances, such as the case study in Argentina discussed above, investigations will benefit from cross references with data from other jurisdictions. This is only possible when data on beneficial owners is publicly accessible.

The EITI has been a key driver for transparency in extractives. Requirement 2.5 of the 2019 EITI Standard recommends that “implementing countries maintain a publicly available register of the beneficial owners of the corporate entity(ies) that apply for or hold a participating interest in an exploration or production oil, gas or mining licence or contract, including the identity(ies) of their beneficial owner(s), the level of ownership and details about how ownership or control is exerted”.[30] Recognising corruption risks, the requirement also notes that the definition of a beneficial owner should specify reporting obligations for PEPs.

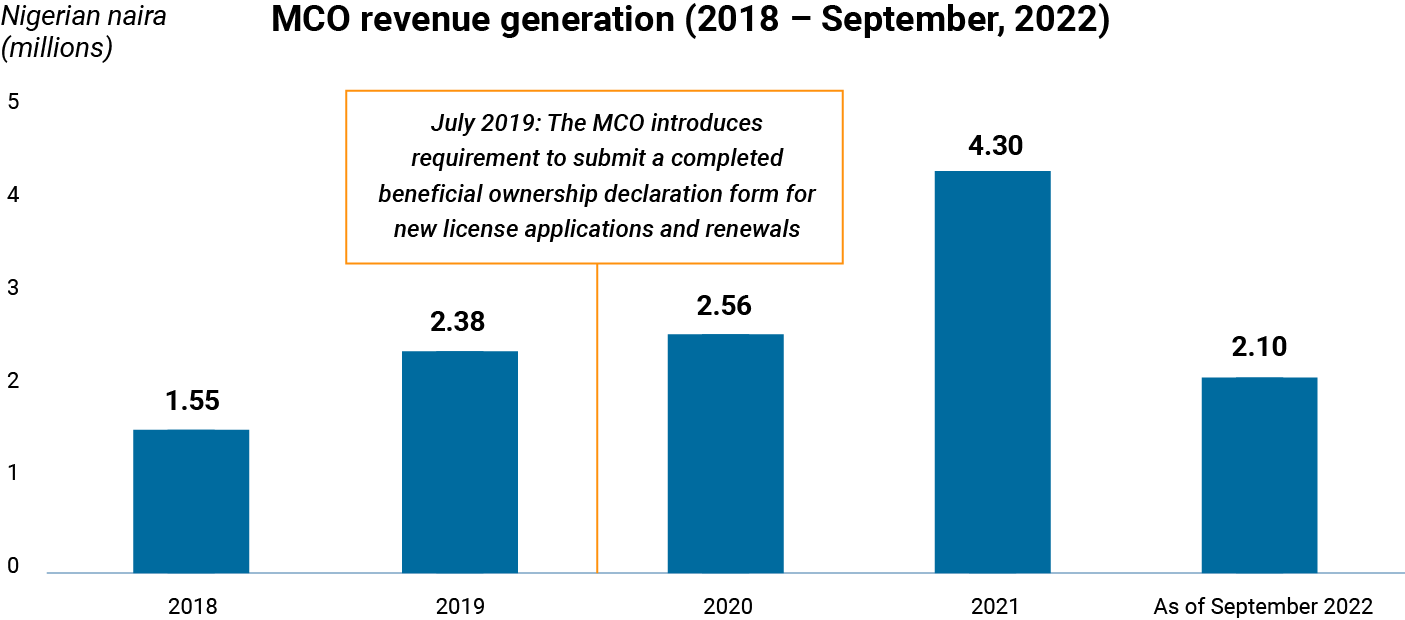

Using beneficial ownership data in decisions to award mining licenses in Nigeria[31]

Nigeria’s Mining Cadastre Office (MCO) is tasked with the administration and management of titles for roughly 44 minerals in accordance with Nigerian law and the principles of the agency, including transparency.

In July 2019, the MCO made the submission of a completed beneficial ownership declaration form a precondition for new license applications and renewals. The office uses the data to decide whether new licenses should be awarded to specific companies, enabling it to improve the regulation of licensing and revenue mobilisation. Staff also use ownership data to identify previous mineral title holders seeking to avoid payment of outstanding debts by abandoning their old licenses and applying for new ones using newly formed companies. Where mining title holders listed in declarations of companies applying for new licenses are identified as having interests in companies that have failed to pay annual service fees in the past, they are compelled to clear their debts or have their new applications rejected.

From 2019 to 2021, 15,483 applications were rejected and 4,997 revoked, while in the first quarter of 2022 there were over 6,500 active titles. While the MCO has adopted other reforms to the applications review process alongside the requirement for beneficial ownership data, senior staff reported in an interview that “our revenue profile has increased tremendously by using the beneficial ownership data”. In 2021, the revenue generated by the office reached its highest ever level at NGN 4.3 billion (approximately USD 9.8 million) and more than doubled the level of revenue in 2018.

Data sharing and cooperation with other government agencies is a core component of the MCO’s approach. MCO staff note that in the months and years ahead, “the most important thing is for us to link up” so that all government agencies with a need for beneficial ownership data and other mining license information will be able to access it.

The launch in November 2022 of a new electronic mining cadastre system (EMC+) marks a key milestone in this journey. The aim is for this system to be shared among countries in the West African region. As Nigeria strengthens its beneficial ownership data ecosystem, the MCO plays a key role as a data supplier. The MCO’s beneficial ownership declarations use a form that was designed to align with Nigeria EITI’s (NEITI) Beneficial Ownership Portal for the solid minerals industry, and beneficial ownership data gathered through the MCO’s licensing process is used to update NEITI’s register.

Following the launch of EMC+, there will also be a data supplier for Nigeria’s Corporate Affairs Commission (CAC), which houses the country’s newly launched whole-of-economy register. In addition, the MCO collaborates closely with investigative and law enforcement bodies, including the Nigerian Financial Intelligence Unit and the Economic and Financial Crimes Commission. These bodies may source beneficial ownership information along with other information about mining license applicants and holders from the MCO in investigations, including into cases of corruption.

Peer learning delivered through the Opening Extractives programme is supporting beneficial ownership transparency in Nigeria.

Data-driven approaches to effective company due diligence

Beneficial ownership data is used by entities regulated under AML legislation, such as banks and other companies, to complete mandatory know-your- customer checks. These checks use data from beneficial ownership registers or data providers who, in turn, rely on registers.[32] Many beneficial ownership data providers have pioneered data-driven approaches to due diligence and incorporated these into software solutions for banks and other businesses, sometimes referred to as the RegTech sector. AML-regulated institutions are often instrumental in detecting when transactions may be the proceeds of corruption. Their access to robust data is critical to ensuring AML policies succeed as well as spurring on innovation in beneficial ownership data use that can benefit anti-corruption efforts more broadly.

Beneficial ownership data is also used by both state-owned and private companies to carry out due diligence on the customers, suppliers, vendors and business partners with which a company chooses to engage. For example, Petrobras, a state-owned petroleum company in Brazil, now requires suppliers, customers, sponsored companies, partners and other counterparties to report their ultimate beneficiaries.[33] Key proprietary information sources used by companies for due diligence purposes incorporate and depend on ownership information directly sourced from beneficial ownership registers.

In a survey conducted by Open Ownership on the use of such data by private entities, mining and minerals companies all reported ownership information to be “somewhat” to “very” important for carrying out periodic anti-corruption assessments or compliance processes.[34] For electronics manufacturing and mining and minerals companies, such data is considered relevant for complying with legislation, such as the United States Foreign Corrupt Practices Act and the UK Bribery Act, and with AML regulations. This is amplified in contexts where corruption and bribery risks are perceived to be more prevalent.

Using beneficial ownership data to raise red flags as part of customer due diligence[35]

The business development team for an international mining equipment manufacturer operating in Zambia routinely used beneficial ownership information to perform customer due diligence on artisanal mining companies seeking to purchase equipment, including checks for potential corruption. A former manager at the manufacturer described using data on mining licenses from the Zambia EITI (ZEITI) register, along with company information from PACRA, on a daily basis to look for red flags like the potential use of shell companies or noncompliance with mining license regulations. Where due diligence checks raised red flags, the team would immediately terminate the process to avoid reputational damage or legal liability.

The manufacturer denied quotes to companies in cases where it discovered data that shareholders and beneficial owners were politically affiliated. This was grounds to immediately cease business to avoid becoming complicit in corruption. They also denied quotes when there were signs of shell companies being used.

The interviewee reported that, in one case, “we found out through the [ZEITI] list of licenses that there was one individual who owned over 300 exploration and artisanal mining licenses in Zambia through different companies [...] it was not detected by the mining commission. This poses a problem for us”. The apparent effort being taken to hide ownership through shell structures raised questions, and they did not continue with a quote. In another case, a quote was denied where the beneficial owner listed for a potential customer was an apparent shell company that had “ridiculous” contact information, including an obviously false email address and a physical address which, following a visit, turned out to be in the middle of a field.

While the company concerned operates in multiple countries, including Burkina Faso and the Democratic Republic of the Congo (DRC), it was only possible to conduct routine due diligence checks using ownership data in Zambia. In other countries, digital information was not available, and the costs for retrieving non-digital records in person were prohibitive. However, the team did encounter challenges using PACRA’s data.

The need to pay by record meant that the company checked beneficial ownership information only around 10-20% of the time, when it would have done so 100% of the time if the data were free to use. In addition, the manager said that more verification of basic information, such as physical addresses, was needed.

The company would also have benefited from greater data integration between mining license data and PACRA data, and for authorities to have a “holistic view of where the money is coming from”. Achieving these objectives would require structured and interoperable beneficial ownership data to be made available in bulk. This could include connecting data on bank accounts linked to companies, or licenses they are linked to, to see how many are operating out of one account. It could also include information on compliance with regulations like shareholder and beneficial ownership reporting and filing of tax returns.

A recent corruption case involving Glencore, a diversified resources company, illustrates the potential impact of companies’ failure to undertake proper third- party due diligence. The company pleaded guilty in June 2022 for bribery related to African oil operations, in part through agents and third parties.[36] Civil society actors have highlighted that Glencore implementing a third-party due diligence system that raises red flags for clear corruption risks is part of the solution. Other relevant measures include screening beneficial ownership of agents for PEPs with conflicts of interest, and for individuals or entities convicted or otherwise credibly shown to have engaged in corruption-related offences.[37]

In its recent anti-corruption reforms, Glencore has begun voluntarily disclosing the beneficial owners of its joint venture partners and its agents – particularly high-risk third parties.[38] Glencore’s 2021 ethics and compliance report states that its procedures require that they obtain beneficial ownership information and that they “will not partner or contract with any business partners assessed as a high corruption risk that decline to identify their beneficial owners, unless appropriate mitigation measures are implemented to reduce corruption risk”.[39]

Combining beneficial ownership information with other data in a digital due diligence platform to detect potentially corrupt business partners [40]

A Ukrainian company called YouControl made use of data from the country’s beneficial ownership register to develop its “analytical system for compliance, market analysis, business intelligence, and investigation”. In Ukraine, anti-corruption was at the heart of a series of reforms that took place following the 2014 Revolution of Dignity, including establishment of the world’s first public beneficial ownership register.[41] YouControl collects, aggregates and analyses data from 180 credible sources – including Ukraine’s register – to offer comprehensive company profiles including information that should raise red flags, such as unpaid taxes or pending lawsuits.

Case studies on YouControl’s website provide examples of companies which have not entered into commercial relationships with counterparties that have committed fraud and embezzled public funds, thereby avoiding the risk of becoming complicit in laundering the proceeds.[42] Customers have also reported irregularities to the authorities. YouControl is a promising and innovative example of how third parties can use beneficial ownership registers if they are made public, open and free to use.

After Russia’s invasion of Ukraine, the company developed a new tool called RuAssets, which allows companies to screen links with PEPs and individuals on sanctions lists in Belarus, Kazakhstan, Russia and Ukraine. It uses beneficial ownership information to help make connections between companies and individuals. While its primary purpose is to facilitate compliance with sanctions, it can also be used to surface potential conflicts of interest and other red flags for corruption.

Analysing data to deliver anti-corruption insights and impact

Beneficial ownership information can be used to detect patterns relevant to identifying corruption risks and evaluate the effectiveness of anti-corruption policies. Law enforcement, civil society, governments and others can analyse data as a means of better understanding patterns and behaviours that may point to corrupt practices. Such analysis can offer new insights into how corrupt actors navigate and exploit financial and economic systems, and trigger proactive investigations. The full potential of beneficial ownership data is still untapped, and significant potential remains to integrate it with other datasets to informanti- corruption policy making and uncover systemic risks.

EITI multi-stakeholder group in Ukraine discusses the importance of the verification of data in the public register.

Ownership information is already helping researchers evaluate impact in a range of policy areas, including in domestic resource mobilisation. For example, a recent study using beneficial ownership data[43] found that implementation of the Common Reporting Standard – which supports tax transparency through the automatic exchange of financial account information between jurisdictions – led to a change in how account holders in tax havens stored their wealth.[44] Similarly, the Organisation for Economic Co-operation and Development (OECD) uses data from the Open Ownership Register in its Analytical Database on Individual Multinationals and Affiliates. Its aim is to provide new insights on individual multinational enterprises (MNEs) and their global profiles. According to the OECD, “understanding where MNEs are, how they operate, and where they pay taxes is crucial for sound policy making and sound macroeconomic statistics”.[45]

Evaluating policy effectiveness

An iterative approach is often required to implement ownership transparency effectively, and data analysis can support the improvement of policies, regulations and business processes that jurisdictions have put in place to promote ownership transparency. Policy actors can use the data they hold to help understand the effectiveness of their disclosure regime in supporting anti-corruption policy aims. Civil society and journalists can also support this objective by using public data to hold governments to account for their commitments to effectively detect and deter corruption through reforms.

For example, Scottish limited partnerships (SLPs) – a legal formation with known corruption-related money laundering risks[46] – were not required to disclose beneficial ownership information in the UK when its register was established. After the number of new SLPs almost doubled in the year after the register’s launch, and these were linked to movements of USD 80 billion from Russia, the UK government brought SLPs within scope of beneficial ownership transparency rules, and the rate of new SLPs being set up dropped by 80%.[47] This data suggests the lack of transparency was an important factor in individuals choosing to use SLPs, and that their subsequent inclusion in the scope of disclosures was a deterrent. The media has since reported on similar patterns that point to the potential abuse of Irish limited partnerships and Northern Irish limited partnerships, which continue to be excluded from the scope of beneficial ownership reporting requirements in the UK.[48]

Using insights from the analysis of bulk data on UK limited liability partnerships to improve AML policies[49]

Recent research by Transparency International UK (TI-UK) used analysis of bulk data on the ownership of UK limited liability partnerships (LLPs) to generate recommendations for the UK government and strengthen their approach to AML. These included calls to increase the role of Companies House in ensuring data accuracy. One of the measures for achieving this was for Companies House to require proof of the identity of beneficial owners.[50]

The analysis covered more than 50 corruption and money laundering cases representing approximately USD 730 billion in suspicious transactions involving UK LLPs.[51] It identified eight characteristics that point to LLPs’ potential abuse for serious financial crime. When comparing these characteristics to all UK-incorporated LLPs, the researchers found that more than one in ten (over 21,000) have characteristics “identical to those used in serious financial crimes, such as bribery, embezzlement of public funds and sanctions evasion”. Based on available evidence, they estimate the economic damage caused by this network of LLPs to be in the tens to hundreds of billions of pounds.

One characteristic identified in the sample group was the presence of specific patterns in beneficial ownership information. Where UK LLPs in the sample have data on persons with significant control (PSC), “it is frequently either non-compliant or a natural person based in Russia, Ukraine, a Baltic state or somewhere else in the former Soviet Union”. Similar patterns were found in the wider group of all LLPs. Public beneficial ownership information is available for 1,077 of these LLPs.[52]

Over 80% of filings are related to non-UK nationals; nationals from former Soviet states constitute half of these, with the most frequently occurring nationality in the data overall being Russian (17%). While not evidence of wrongdoing, the proportion of nationalities from post-Soviet states appears to be unusually high.[53]

Moreover, the analysis finds common forms of non-compliance among LLPs in the PSC register data. UK legal entities can be exempt from disclosure if their parent legal entities are already required to disclose beneficial ownership information in the UK, so the reporting entity is not required to do so again. However, at least a quarter of these types of filings in the LLP sample referred to companies based in secrecy jurisdictions, meaning the LLPs are non-compliant and the beneficial owners remain obscured. Where UK-based entities were reported, these were not always subject to UK disclosure requirements. Thus the analysis revealed clear compliance issues in the UK regime, and enabled TI-UK to generate specific policy recommendations to rectify these gaps.

Analysing data to uncover systemic corruption risks

Beneficial ownership data disclosed to meet the EITI’s requirements has the potential to equip civil society with information that helps them better understand and monitor corruption in extractives. Without the availability of structured data, EITI reports help users link public ownership data to information on contracts, state-owned enterprises and revenues. These have triggered or informed investigations into specific deals in Cameroon, the DRC, Indonesia and Liberia.[54] More jurisdictions are now producing structured data and making it available in bulk, enabling analysts to proactively identify corruption risks.

For example, the civil society organisation Directorio Legislativo recently launched a platform for detecting potential corruption in Colombia called Joining the Dots[55] and is currently establishing a similar project in Nigeria. The project seeks to surface conflicts of interest and other red flags among companies that hold extractive licenses by combining data on beneficial owners and on PEPs with asset declaration form information. In Nigeria, it will use algorithms designed in consultation with local partners to identify context- specific risk factors and analyse connections between companies and PEPs. Bulk analysis can help reveal structural vulnerabilities to corruption. Staff note that the absence of public declarations of financial interest in Nigeria, which were used for the platform in Colombia, makes information from beneficial ownership registers essential.[56]

The project uses data from NEITI’s register and the CAC’s newly-launched public beneficial ownership register, although to date a lack of access to bulk data from the CAC register has been a challenge.

Other avenues for novel forms of data analysis are also being explored. New initiatives connecting ownership data to sanctions and real estate information could help play a role in identifying and countering kleptocracy and strategic corruption, issues which have taken on new salience since Russia’s invasion of Ukraine.[57] In resource-rich countries, inflated contracts are a known means of acquiring and distributing ill-gotten gains from natural resources.[58] By combining open contracting and spending data with structured ownership information, anti-corruption actors may be able to identify possible deviations from industry or market norms and determine the identity of those benefitting.

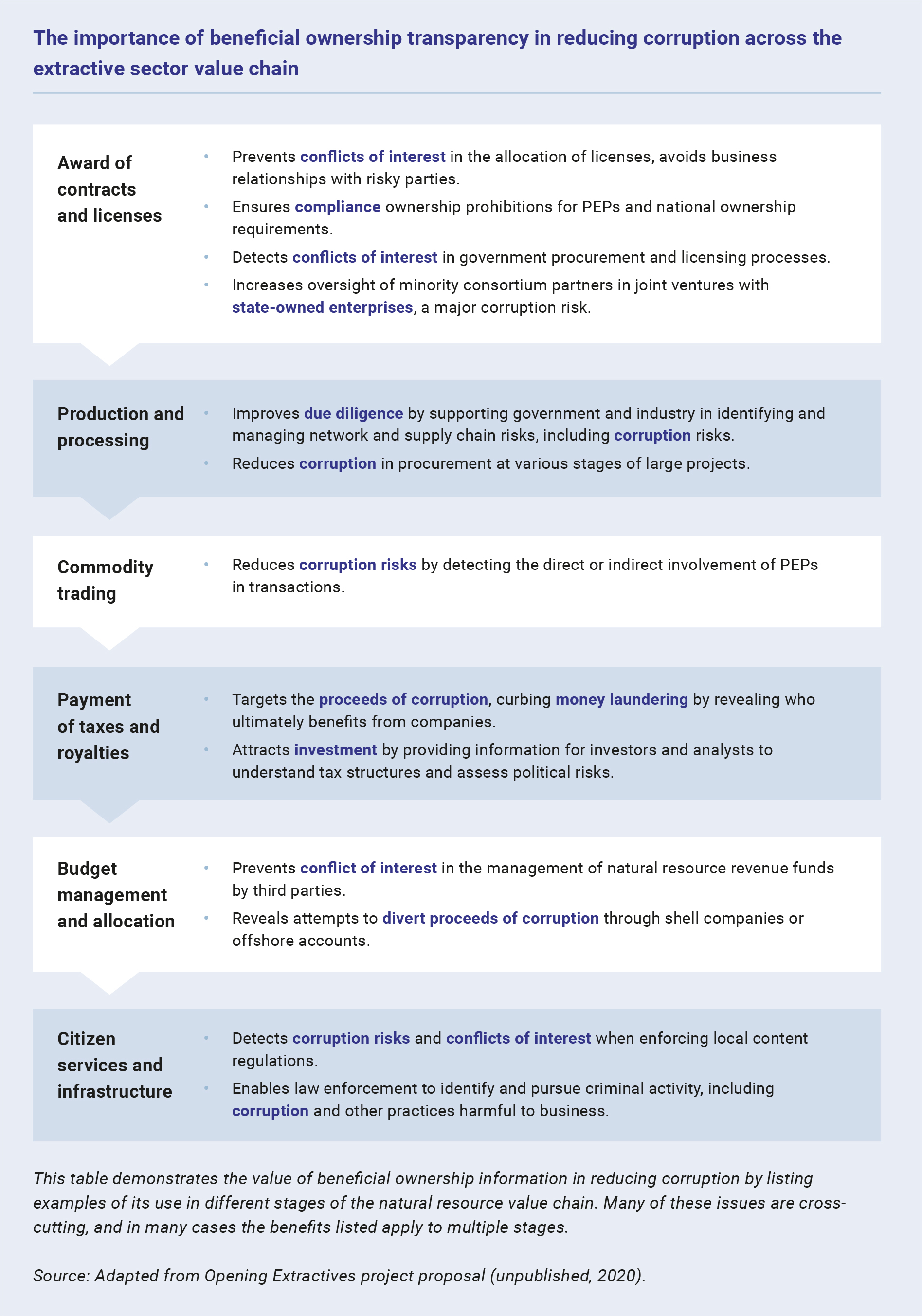

The importance of beneficial ownership transparency in reducing corruption across the extractive sector value chain

↳ Award of contracts and licenses

- Prevents conflicts of interest in the allocation of licenses, avoids business relationships with risky parties.

- Ensures compliance ownership prohibitions for PEPs and national ownership requirements.

- Detects conflicts of interest in government procurement and licensing processes.

- Increases oversight of minority consortium partners in joint ventures with state-owned enterprises, a major corruption risk.

↳ Production and processing

- Improves due diligence by supporting government and industry in identifying and managing network and supply chain risks, including corruption risks.

- Reduces corruption in procurement at various stages of large projects.

↳ Commodity trading

- Reduces corruption risks by detecting the direct or indirect involvement of PEPs in transactions.

↳ Payment of taxes and royalties

- Targets the proceeds of corruption, curbing money laundering by revealing who ultimately benefits from companies.

- Attracts investment by providing information for investors and analysts to understand tax structures and assess political risks.

↳ Budget management and allocation

- Prevents conflict of interest in the management of natural resource revenue funds by third parties.

- Reveals attempts to divert proceeds of corruption through shell companies or offshore accounts.

↳ Citizen services and infrastructure

- Detects corruption risks and conflicts of interest when enforcing local content regulations.

- Enables law enforcement to identify and pursue criminal activity, including corruption and other practices harmful to business.

This demonstrates the value of beneficial ownership information in reducing corruption by listing examples of its use in different stages of the natural resource value chain. Many of these issues are cross- cutting, and in many cases the benefits listed apply to multiple stages.

Source: Adapted from Opening Extractives project proposal (unpublished, 2020).